Navigating the Amazon and marketplace tools landscape can feel like you’re stuck in a maze. You’ve got all-in-one platforms, specialized software, flashy dashboards, and so many metrics that your head spins. And yet, the big question remains: which tool actually helps you grow your business without wasting your time?

In this article, we’re comparing three well-known platforms in the space: WisePPC, IO Scout, and Helium 10. Each one was built with marketplace sellers in mind, but they solve different problems. If you’re wondering which one will actually fit your workflow, budget, and goals, let’s get into it.

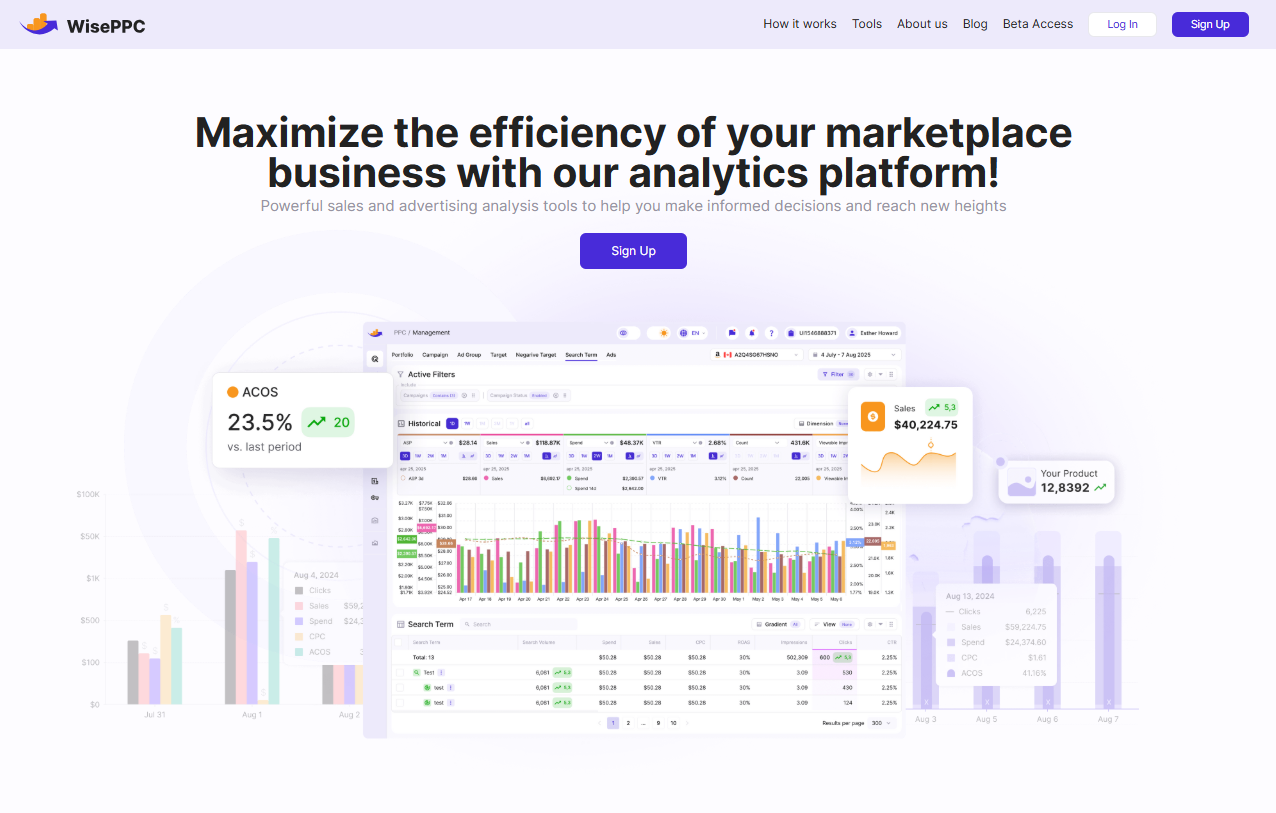

What We Built WisePPC For

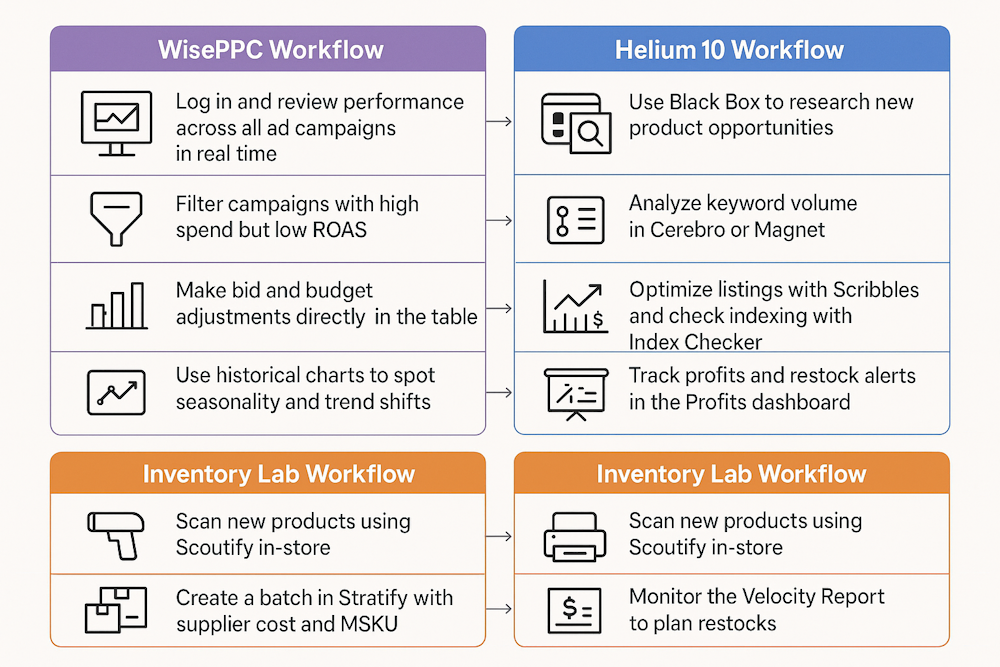

We created WisePPC because we saw a gap. Sellers had access to product research tools, keyword finders, and listings optimizers, but when it came to actually running ads and understanding what was working, they were left guessing. We built WisePPC to give teams visibility, clarity, and real control over their advertising performance.

WisePPC is all about actionable data. You don’t just get reports – you get smart alerts, visual highlights, and real-time metrics that show what’s working and what’s not. Whether it’s adjusting bids in bulk, spotting wasted spend, or figuring out if your sales came from ads or organic traffic, our platform gives you that clarity.

If you manage a few dozen products or a few thousand, the system scales with you. We offer historical data storage well beyond Amazon’s default 60-90 days. You can spot trends over months or even years, and we don’t charge extra for that.

Key tools include:

- Real-time tracking of ad KPIs like ACOS, TACOS, ROAS, CTR

- Inline campaign editing without jumping between screens

- Visual anomaly detection via gradient-based tables

- Placement performance tracking (right down to keywords)

- Multi-account dashboards for agencies or bigger sellers

- Bulk editing tools that save hours of manual work

We’re also working on inventory forecasting, smart bidding enhancements, and AI-based campaign optimizations.

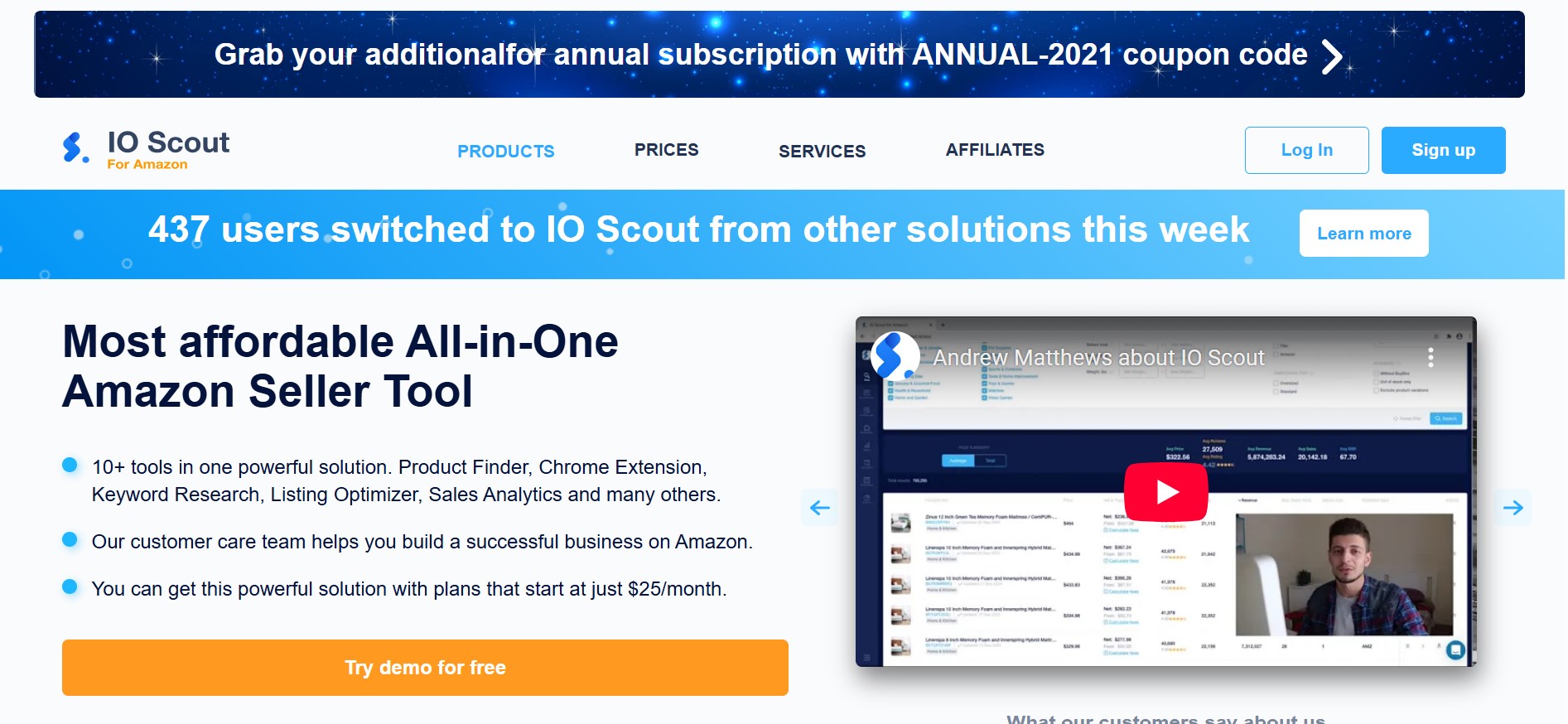

What IO Scout Focuses On

IO Scout is designed for sellers who need help finding what to sell. It’s a streamlined, relatively affordable product research platform with a focus on simplicity. If you’re early in your journey and looking for a tool that helps you spot profitable items and keywords, IO Scout offers a good baseline.

It has a product database of over 200 million Amazon listings, with hourly updates in some categories (like books). You can track up to 85 products and 85 keywords in the top plan, and get access to sales estimators, FBA fee calculators, and historical trends.

What sets IO Scout apart is its pricing. It’s one of the cheaper tools on the market and includes features like a Chrome extension in every plan.

Here’s what you get:

- Product research with filters for category, reviews, pricing, etc.

- Keyword research tool with volume and relevancy metrics

- FBA calculator for cost and margin breakdowns

- Product tracking tool with hourly data refresh (in some cases)

- Simple sales estimator based on BSR

- Chrome extension for on-the-fly analysis

It doesn’t do ad optimization, performance analytics, or campaign tracking. So if that’s part of your workflow, you’ll need a second tool.

What Helium 10 Does Differently

Helium 10 positions itself as the all-in-one software suite for Amazon sellers. It includes product research, keyword tools, listing optimization, refund tracking, inventory protection, and some advertising features (if you pay extra for Adtomic).

It’s a beast in terms of feature count, which makes it a great fit for sellers who want everything under one roof – as long as you’re ready to pay for it.

Some of the more well-known tools include:

- Black Box for product research across 450+ million listings

- Magnet, Cerebro, and Frankenstein for keyword discovery

- Scribbles for listing creation and optimization

- Trendster for visualizing seasonal demand

- Xray Chrome extension (limited in the free plan)

- Adtomic (extra cost) for PPC campaign automation

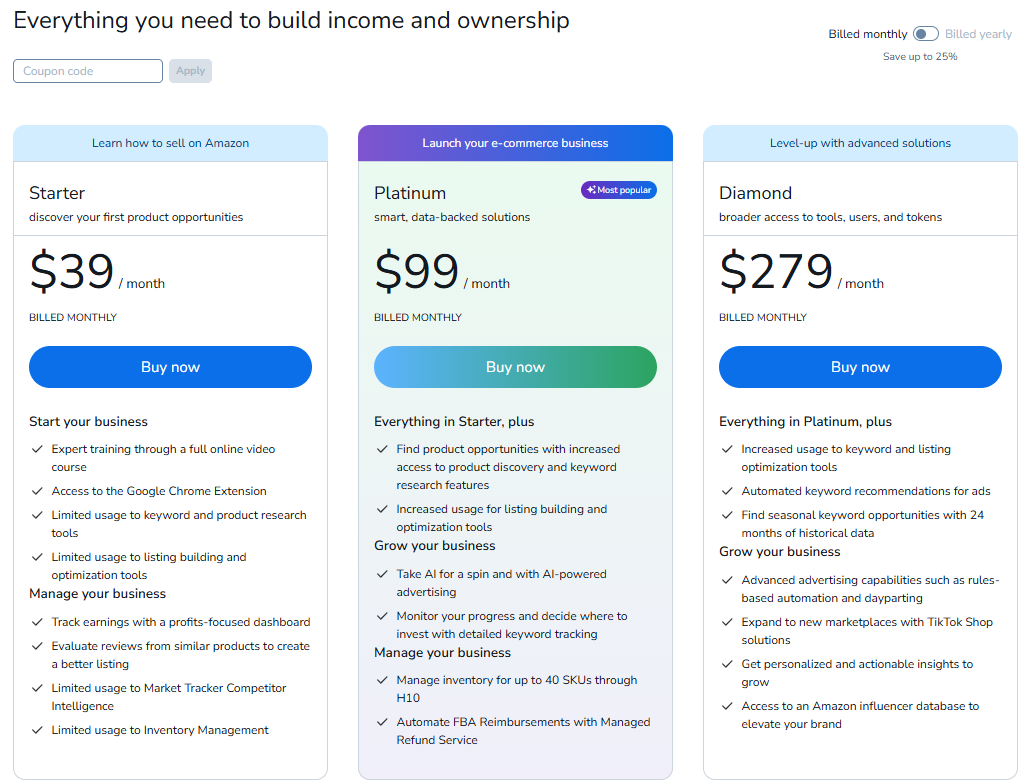

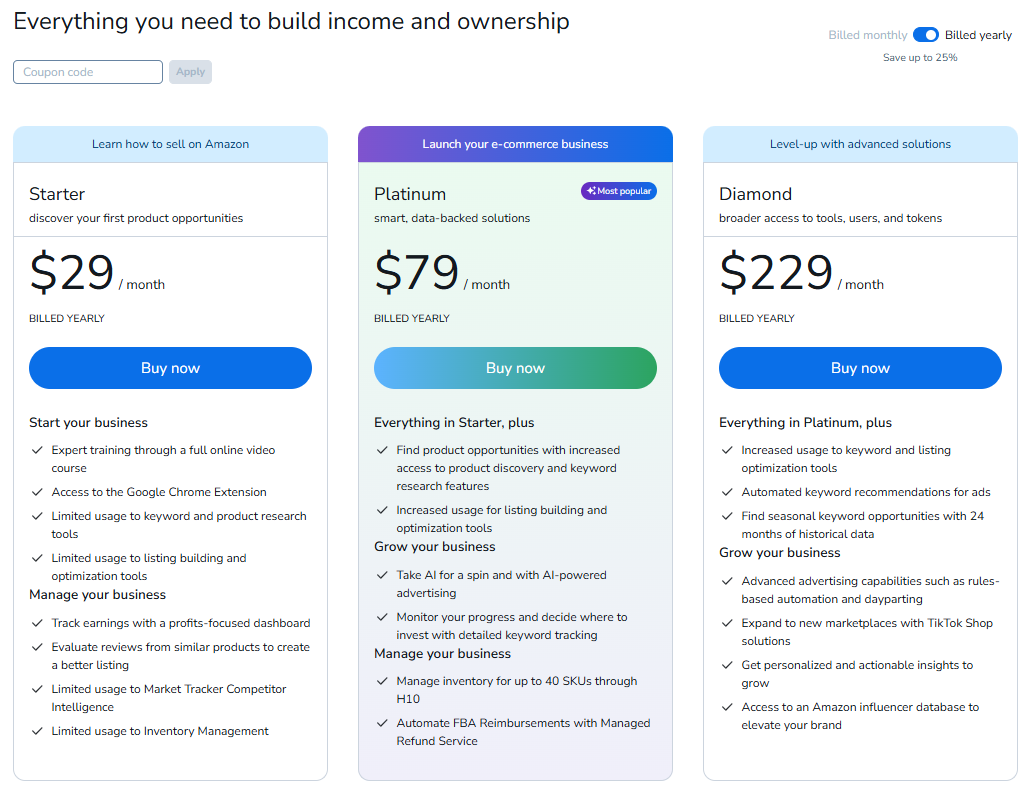

Helium 10’s pricing is where it can get tricky. The free plan is very limited. The Platinum plan ($97/month) gives you access to core tools with usage caps. The Diamond plan ($197/month) increases those caps, and the Elite plan ($397/month) includes access to workshops and some extra perks.

It’s worth noting that Helium 10 is more like a toolbox than a single streamlined experience. That can be a plus for large operations, but for sellers who just want clarity, it might feel like a lot of toggling and bouncing between dashboards.

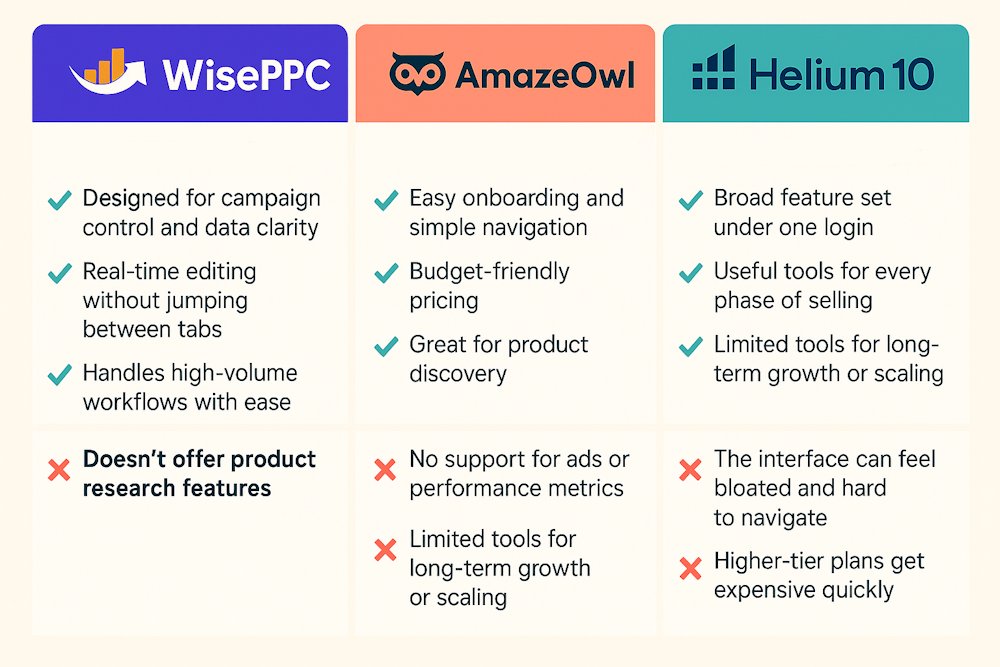

The Core Differences at a Glance

Here’s a quick side-by-side:

| Feature | WisePPC | IO Scout | Helium 10 |

| Focus Area | Advertising analytics & optimization | Product & keyword research | All-in-one toolkit for Amazon |

| Real-Time Data | Yes | No | Limited |

| Product Database Size | N/A | 200+ million | 450+ million |

| Keyword Research | No (not a focus) | Yes | Yes |

| Ad Spend Optimization | Yes | No | Limited (via Adtomic) |

| Inventory Forecasting | Coming soon | No | No |

| Chrome Extension | N/A | Included in all plans | Included in most plans |

| Free Plan | Yes (Beta access) | No | Yes (limited) |

| Multi-Account Dashboard | Yes | No | No |

| Historical Data Access | Unlimited | Unlimited | 60-90 days |

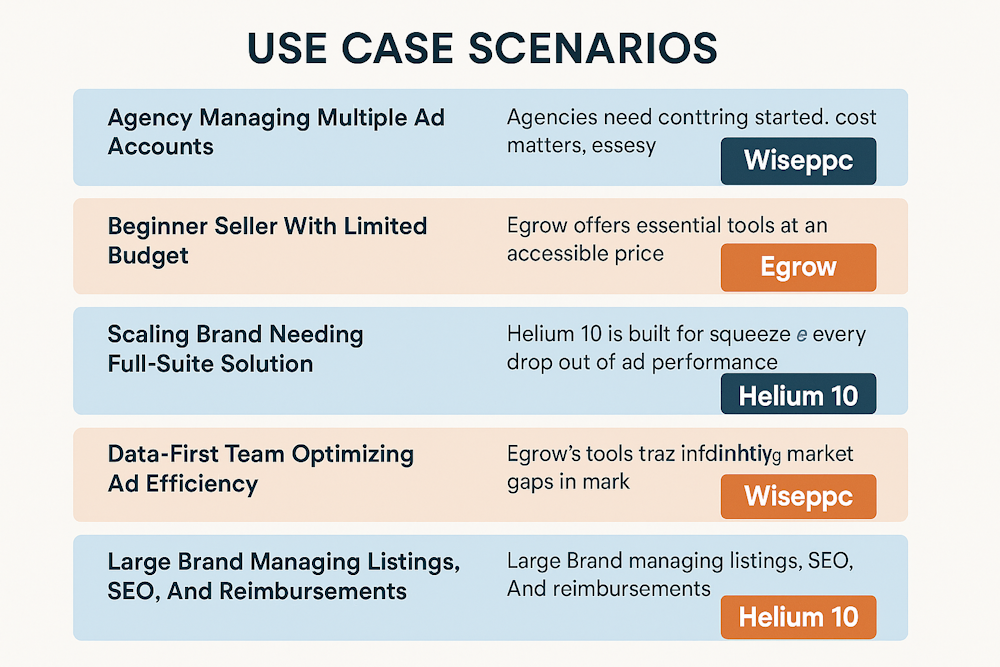

When to Choose Each Tool

Choosing between WisePPC, IO Scout, and Helium 10 isn’t about which one is better in general. It’s about what you actually need. Here’s a breakdown to help make that decision clearer.

When WisePPC Makes Sense

If you’re actively selling on Amazon or Shopify and you’re running ad campaigns, that’s exactly where we come in. WisePPC is built for sellers who are past the product research phase and now need to understand what’s actually happening with their ads. We designed the platform to give you full visibility into performance across multiple metrics in real time. Whether it’s ACOS, TACOS, ROAS, or just knowing which targets are draining your budget, we help bring all of that into focus.

What sets us apart is how we handle data. You don’t have to jump between screens or wait for reports to generate. You can track results as they happen, adjust campaigns directly from the dashboard, and compare long-term trends that Amazon doesn’t store. This matters when you’re trying to scale or manage multiple accounts. Instead of guessing what went wrong last month or relying on spreadsheets, you get clear insights to move faster and smarter.

When IO Scout Fits Better

On the other hand, IO Scout is more tailored to people just getting started. If you’re trying to figure out what to sell or whether a product idea is worth the risk, IO Scout gives you the basic tools to research demand, check profitability, and track a few items over time. It’s not built for campaign management or in-depth performance analysis, but that’s okay if you’re still in the early stages.

The platform keeps things simple and affordable, which makes it accessible to new sellers. It doesn’t go deep into advertising or post-launch insights, so once your store starts growing, you’ll probably outgrow the tool. But as a first step into Amazon, it does its job.

When Helium 10 Is the Right Call

Then there’s Helium 10. It’s definitely the most feature-packed of the three, covering product research, keyword tracking, listing optimization, and even some ad automation if you pay for it. For sellers who want one tool to handle everything from research to optimization, Helium 10 can be a convenient option.

That said, it comes with a higher price tag and a bit of a learning curve. You’ll need time to dig into all the different modules, and not every feature is as refined as a specialized tool. Still, for those who want to centralize their workflows under one login and don’t mind paying extra for it, Helium 10 delivers broad functionality.

Final Thoughts

There’s no universal winner in the WisePPC vs IO Scout vs Helium 10 debate. The better question is: what are you actually trying to solve?

If you’re deep into campaign management, tracking ad performance, and want to stop guessing where your budget is going, then a focused platform like ours at WisePPC will feel like a breath of fresh air. But if you’re just entering the Amazon space and still figuring out what to sell, IO Scout gives you the right tools without overwhelming you. And if you’re looking for a one-stop shop that covers nearly every part of the Amazon process under one roof, Helium 10 is probably the strongest contender, provided you’re ready for the cost and the learning curve.

At the end of the day, the tool that fits best is the one that doesn’t just offer features, but actually fits into the way you work. Whether you need precision with your ads, help with research, or everything bundled into one dashboard, the good news is there are strong options on the table. Hopefully, this breakdown gave you a clearer sense of what each platform brings, and what kind of seller each one truly supports.

FAQs

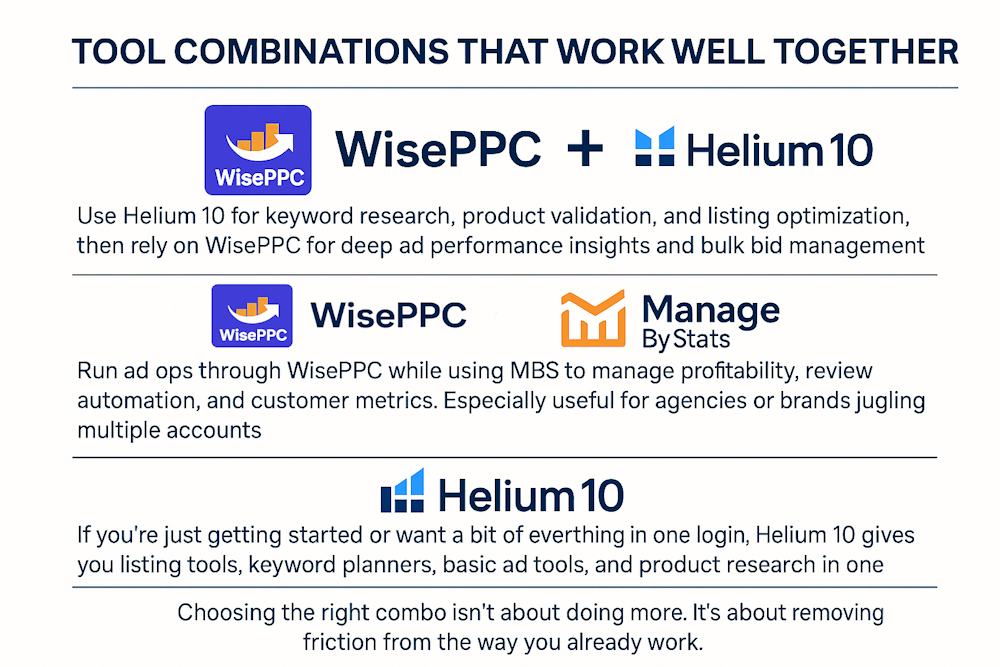

Can I use more than one of these tools at the same time?

Yes, and in some cases, it actually makes sense. Many sellers use a research tool like IO Scout or Helium 10 alongside a performance analytics platform like WisePPC. Product discovery and campaign optimization aren’t the same job, so pairing tools that specialize in each can cover more ground without overlap.

Is Helium 10 too much for beginners?

It depends on your comfort with software tools and how much of the Amazon process you want to handle inside one system. Helium 10 has a lot to offer, but it can also be overwhelming if you’re brand new and just want the basics without the bloat.

Does IO Scout offer ad tracking or campaign tools?

No. IO Scout sticks to research and basic estimations. If you’re looking for data on how your ads are actually performing, you’ll need a dedicated analytics tool like WisePPC to fill that gap.

How often is the data updated on each platform?

WisePPC gives real-time performance insights with data updated as it happens. IO Scout refreshes product data hourly in some categories, like books. Helium 10’s update frequency varies by tool, but it doesn’t always provide real-time visibility, especially on ad-related data unless you pay for add-ons like Adtomic.

What makes WisePPC different from the other two?

WisePPC isn’t trying to do everything. We’re focused on giving sellers a clear, accurate picture of what’s driving ad performance. We built it specifically to cut down on the guesswork and help you take action faster, especially when you’re scaling or managing multiple accounts.