Best Amazon Product Analysis Tools That Help You Sell Smarter

If you’ve ever tried to pick winning products on Amazon, you know it’s not guesswork – it’s data work. The right tools can show you what’s selling, what’s slipping, and where the next big opportunity might be hiding. In this guide, we’re diving into the Amazon product analysis tools that go beyond surface-level stats. These platforms don’t just dump numbers on you, they connect trends, competition, and demand so you can make decisions that actually lead to sales. Whether you’re launching your first product or managing a whole catalog, the right insights can make all the difference.

1. WisePPC

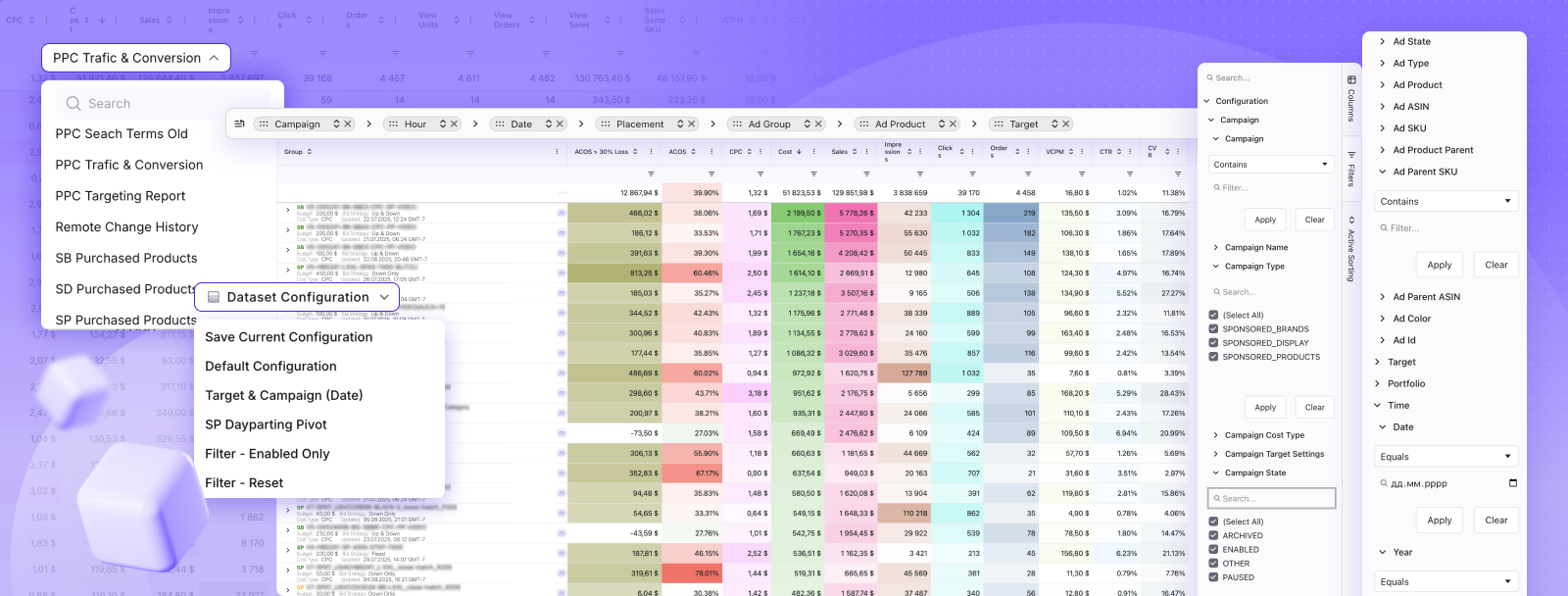

At WisePPC, we focus on helping sellers go beyond surface-level product metrics to understand what actually drives performance on Amazon. Our platform connects advertising data with sales results, so you can see the full picture – how each product performs, what affects conversions, and where growth really comes from. Instead of relying on short-term numbers or disconnected reports, we give sellers long-term visibility across every product and campaign.

We’ve built tools that make product analysis faster and more precise. You can filter performance data by cost type, campaign type, or match type, track trends across months or years, and compare how each product responds to changes in bids or placement. The system highlights what’s working, what’s underperforming, and how ads influence organic sales. For anyone serious about making data-backed product decisions, WisePPC helps turn scattered numbers into insights you can actually use.

Key Highlights:

- Unified analytics connecting product sales and ad performance

- Long-term historical data storage beyond Amazon’s limits

- Advanced filtering for deep product-level insights

- Gradient-based highlighting to spot performance shifts fast

- Real-time metrics like ACOS, TACOS, CTR, and profit

- Bulk editing tools to adjust bids and campaigns efficiently

Best For:

- Sellers who analyze product performance and profitability in detail

- Teams linking ad spend directly to product results

- Brands managing multiple ASINs and marketplaces

- Businesses that rely on long-term, data-driven product insights

Contacts:

- Website: wiseppc.com

- Facebook: www.facebook.com/people/Wise-PPC

- LinkedIn: www.linkedin.com/company/wiseppc

- Instagram: www.instagram.com/wiseppc

2. SellerSprite

SellerSprite focuses on providing a clear, data-backed view of Amazon’s product landscape. Its platform combines product and keyword research tools that pull real-time data directly from Amazon’s frontend. The browser extension works as a lightweight version of the main app, allowing sellers to check ASIN data, pricing, and keyword rankings without leaving a product page. By pairing this with its database tools, users can quickly assess competition and make informed sourcing decisions.

A key advantage of SellerSprite is its continuous data refresh cycle. The system updates product, keyword, and sales data daily or monthly depending on the metric, keeping analysis as close to real-time as possible. Alongside standard research tools, it offers AsinSeed – a reverse ASIN search feature that helps sellers understand which keywords drive visibility and conversions for competitors. Overall, SellerSprite’s focus is on making data easier to interpret and apply in day-to-day product planning.

Key Highlights:

- Real-time browser extension for instant ASIN and keyword insights

- Product and keyword research tools with customizable filters

- AsinSeed reverse ASIN lookup to analyze competitors

- Profitability and sales estimators for better planning

- Data updates on a daily and monthly schedule for accuracy

Best For:

- Sellers needing fresh, daily product data

- Teams running ongoing keyword and listing optimization

- Users comparing ASIN performance across categories

- Private label sellers and cross-border Amazon businesses

Contacts:

- Website: www.sellersprite.com

- Email: [email protected]

- Facebook: www.facebook.com/sellersprite.us

- X (Twitter): x.com/SellerSprite_EN

3. Helium 10

Helium 10 provides a full toolkit for Amazon product research, helping sellers spot profitable niches and understand what makes certain listings perform better than others. The platform combines several tools under one system, including Black Box for product discovery, Xray for in-depth analysis, and a Chrome Extension that simplifies competitive checks right from the browser. Together, they help users evaluate demand, competition, and potential margins without having to jump between multiple apps.

What stands out about Helium 10 is its structured approach to research. Sellers can filter millions of Amazon products by key performance factors, analyze estimated sales or reviews, and track how listings evolve over time. Each feature is built to make decision-making easier: from finding supplier options to running profitability calculations. It’s a solid way for sellers to base product choices on data rather than guesswork.

Key Highlights:

- Black Box search engine for finding product opportunities across categories

- Xray product analyzer for sales, reviews, and pricing insights

- Chrome Extension for quick on-page research directly on Amazon

- Built-in profitability and demand calculators

- Supplier Finder for sourcing products through integrated Alibaba data

Best For:

- Sellers researching new FBA product ideas

- Small and mid-size Amazon businesses expanding their catalog

- Teams comparing competition and tracking product trends

- Users who prefer a single workspace for product and keyword research

Contacts:

- Website: www.helium10.com

- Facebook: www.facebook.com/Helium10Software

- Twitter: x.com/H10Software

- LinkedIn: www.linkedin.com/company/helium10

- Instagram: www.instagram.com/helium10software

4. SmartScout

SmartScout takes a broader view of Amazon’s marketplace, connecting brands, sellers, and categories into one large dataset. The platform gives users visibility into how products, ads, and sales interact across different segments. Its tools help uncover brand performance, advertising strategies, and long-term market trends – allowing sellers to spot new openings or shifts in buyer behavior before they happen. It’s particularly useful for those working at scale or managing multiple brands.

The system’s strength lies in its depth of analysis. SmartScout maps seller history, ad visibility, and keyword overlap while also visualizing how customers move between listings through its Traffic Graph. Sellers can also access the Ad Spy and Share of Voice tools to understand how competitors capture visibility. By blending product-level insights with category-level intelligence, SmartScout turns scattered marketplace data into something much more actionable.

Key Highlights:

- Brand and product databases covering all major Amazon categories

- Ad Spy and Share of Voice tools for advertising visibility tracking

- Scope feature for historical trend and performance visualization

- Traffic Graph for understanding product-to-product connections

- Custom Segments for building tailored market views

Best For:

- Sellers running competitive or wholesale research

- Agencies managing multiple Amazon accounts or brands

- Teams focused on market share, visibility, or ad analysis

- Businesses needing detailed multi-level insights on Amazon’s ecosystem

Contacts:

- Website: www.smartscout.com

- App Store: apps.apple.com/us/app/smartscout

- Facebook: www.facebook.com/smartscout.pro

- LinkedIn: www.linkedin.com/company/smartscoutcom

- Instagram: www.instagram.com/smartscout_com

5. SellerApp

SellerApp gives sellers a straightforward way to find and test product ideas without relying on gut feeling. Instead of guessing what might sell, you can see real data on demand, profit margins, and competition before jumping in. The built-in AI scoring system helps you quickly judge whether a product is worth pursuing, and the filters make it easy to narrow down options based on your goals. It’s the kind of setup that lets you move faster without juggling endless spreadsheets or browser tabs.

What makes SellerApp stand out is how flexible it feels. You can save your own filter presets, track specific products over time, and even export your findings to dig deeper later. The tool also covers multiple Amazon marketplaces, so you can see how trends shift between regions instead of relying on one narrow view. In short, it’s designed to give sellers a clear picture of what’s worth their time and what’s not, without overcomplicating the process.

Key Highlights:

- AI-based Opportunity Score for quick validation

- Huge product database across global marketplaces

- Custom filter presets for repeat searches

- Product tracking with BSR trend insights

- Easy CSV export for extra analysis

Best For:

- Sellers exploring new product ideas with limited data

- Teams running multi-marketplace research

- Users who want fast, filter-based validation

- Beginners looking for a simple, all-in-one research setup

Contacts:

- Website: www.sellerapp.com

- Phone: +1-256-363-0567

- Email: [email protected]

- Address: 4819 Bryant Mdws Dr, Spring, TX 77386, United States

- LinkedIn: www.linkedin.com/company/sellerapp

- Facebook: www.facebook.com/sellerapp

- Instagram: www.instagram.com/sellerapp_insta

- X (Twitter): x.com/SellerApp_Inc

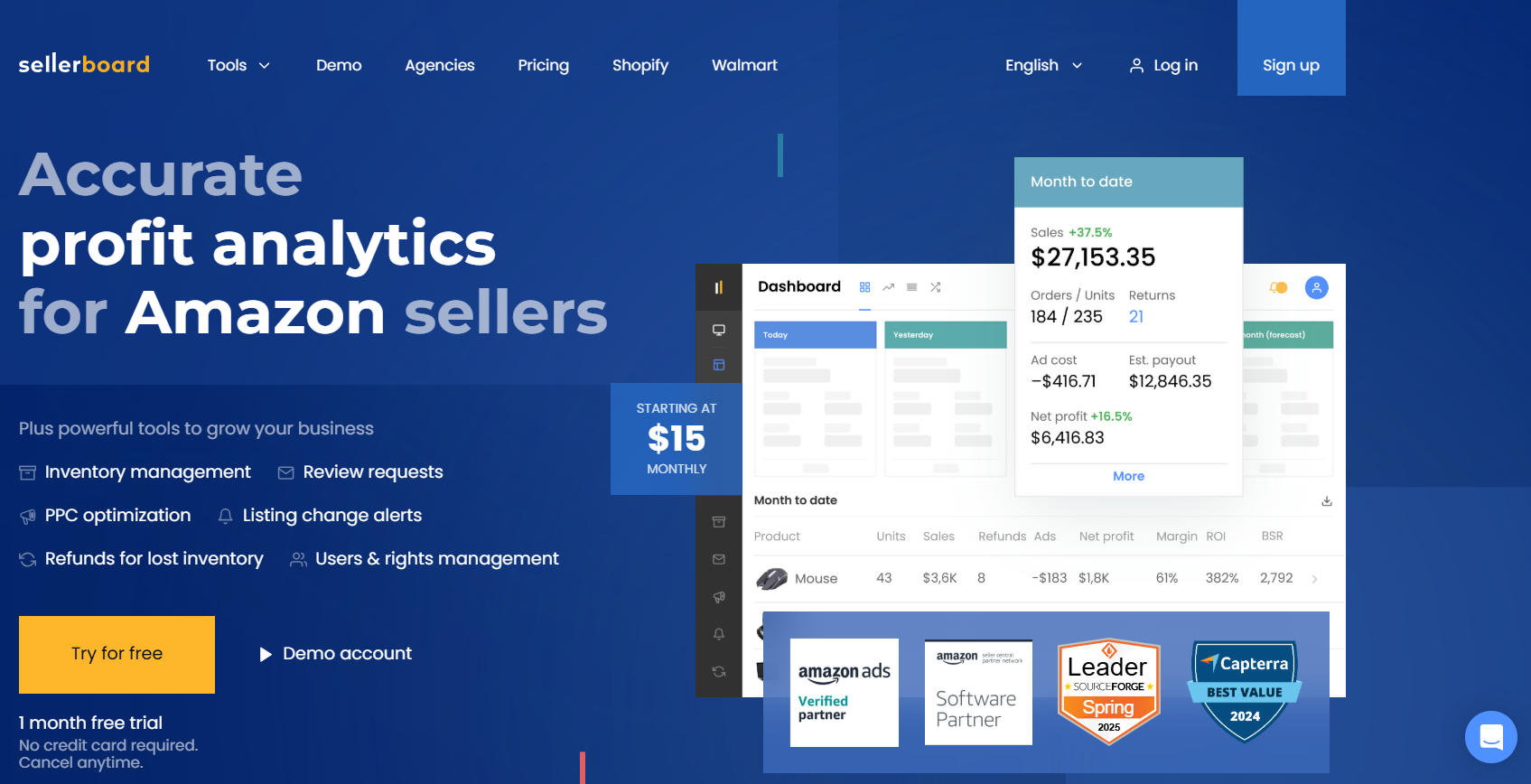

6. Sellerboard

Sellerboard focuses less on hunting for new products and more on understanding how your current ones are really performing. Its dashboard gives you a clear breakdown of sales, refunds, ad spend, and profit margins – the actual numbers that show whether your listings are working or not. You can see which products are making money and which ones quietly drain it, down to every last Amazon fee and operational cost.

It’s not just about numbers though. Sellerboard also helps manage PPC optimization, inventory, and reimbursements for lost stock. You can automate parts of your ad strategy, keep an eye on listing changes, and handle refunds in one place. It feels more like a control room for your Amazon business – keeping everything organized so you can make smarter moves without losing track of the details that impact profit.

Key Highlights:

- Live profit dashboard showing full cost structure

- PPC optimization based on profitability or ACOS

- Alerts for stock issues, listing edits, and Buy Box shifts

- Refund tracking for FBA-related losses

- Role-based access controls for team use

Best For:

- Sellers who need a clear picture of actual profits

- Teams focused on refining PPC and cutting wasted spend

- Businesses managing multiple stores or markets

- Sellers who want to automate day-to-day tracking tasks

Contacts:

- Website: sellerboard.com

- App Store: apps.apple.com/us/app/sellerboard-profit-analytics

- Google Play: play.google.com/store/apps/sellerboard

- E-mail: [email protected]

- Facebook: www.facebook.com/sellerboard

- Twitter: x.com/sellerboard

- Instagram: www.instagram.com/sellerboard.official

7. Jungle Scout

Jungle Scout has been around long enough to earn its place as a go-to tool for serious product analysis. It pulls together research, market intelligence, and brand tracking into one platform. Whether you’re a solo seller testing ideas or part of a brand team managing multiple SKUs, it helps you see what’s trending, what’s oversaturated, and where untapped demand might be hiding. You can dive into keywords, supplier data, and competitive benchmarks without getting buried in raw data.

The real strength of Jungle Scout lies in how deep its marketplace insights go. It tracks both 3P and 1P data, giving a broader look at pricing, category shifts, and advertising performance. Brands use it to benchmark and protect their position, while smaller sellers use it to spot new product opportunities or adjust pricing strategies. It’s less about flashy reports and more about showing what’s happening across the market, so you can make moves that actually line up with demand.

Key Highlights:

- Product and keyword analysis with large-scale tracking

- Market and competitor benchmarking tools

- Insights from both 3P and 1P Amazon data

- Advertising and pricing trend monitoring

- Supplier database and listing optimization support

Best For:

- Sellers tracking product and category trends

- Agencies managing multiple brand accounts

- Teams balancing research with ad optimization

- Larger businesses needing integrated market data

Contacts:

- Website: www.junglescout.com

- E-mail: [email protected]

- Facebook: www.facebook.com/amazonjunglescout

- Twitter: x.com/junglescout

- LinkedIn: www.linkedin.com/company/junglescout

- Instagram: www.instagram.com/junglescout_

- Address: 328 S. Jefferson St., Suite 770, Chicago, IL 60661

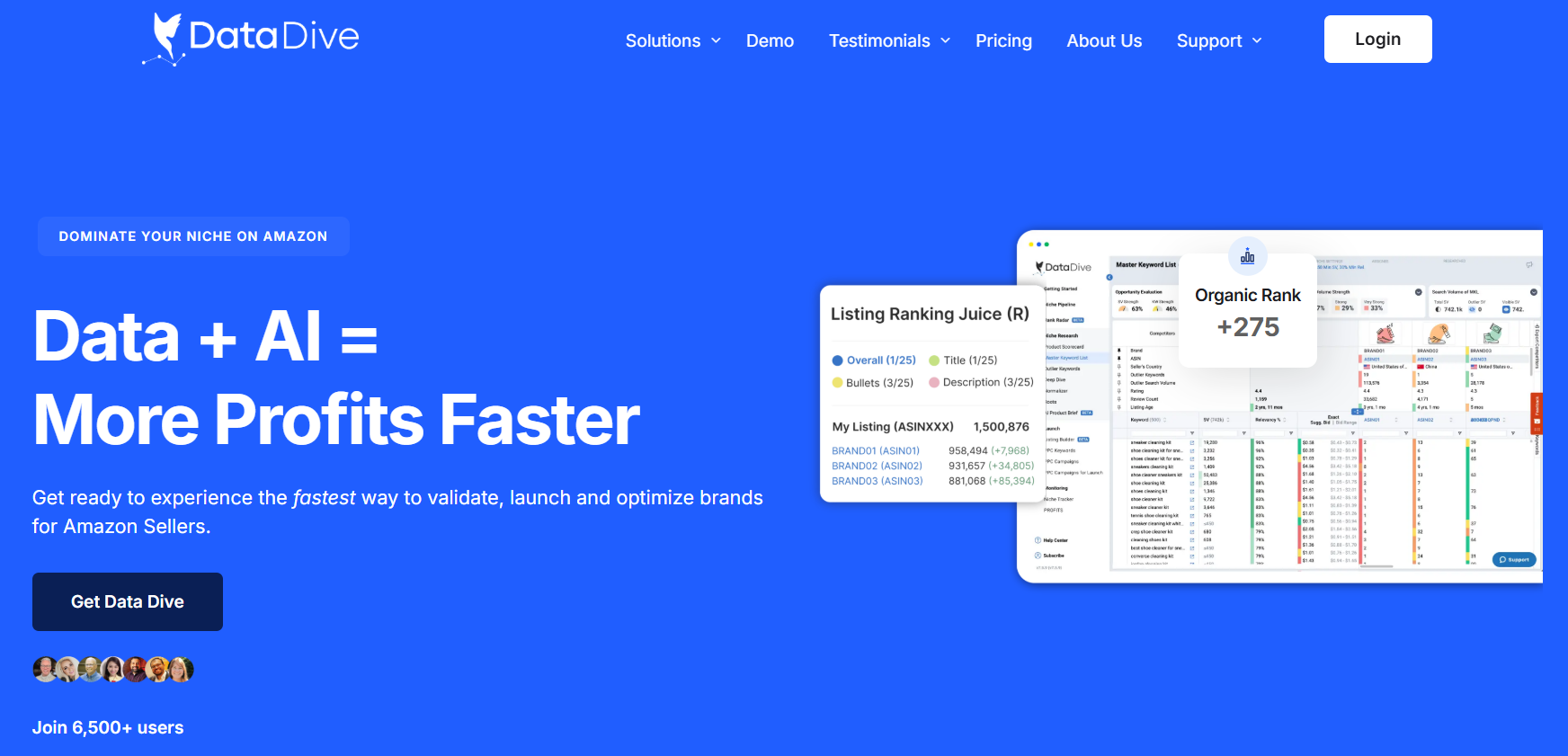

8. Data Dive

Data Dive focuses on helping Amazon sellers validate, launch, and optimize products faster using a mix of data and AI. The platform is built around speed and precision, aiming to simplify how sellers evaluate risk before entering a niche. It gathers key marketplace insights, runs competitive analysis, and highlights gaps in product categories – all within one workflow. This approach lets users test the strength of an idea before committing time or resources to it.

Another strength of Data Dive is how it blends product validation with optimization. Once sellers find a product, they can refine keywords, check rankings, and monitor performance trends without leaving the platform. The workflow tools remove much of the manual work usually tied to Amazon research, allowing sellers to focus more on execution. For those managing multiple brands or building private-label products, Data Dive provides a structured, data-backed way to reduce guesswork.

Key Highlights:

- Fast niche validation with built-in risk evaluation

- AI-supported keyword and listing optimization tools

- Streamlined workflows that cut manual research time

- Chrome-based interface for easy access and usability

- Training and live support resources built into the platform

Best For:

- Private-label sellers launching new brands

- Teams managing multiple SKUs or product lines

- Users who prefer workflow automation over manual data entry

- Sellers focused on faster product validation and optimization

Contacts:

- Website: datadive.tools

- Facebook: www.facebook.com/groups/ssddfba

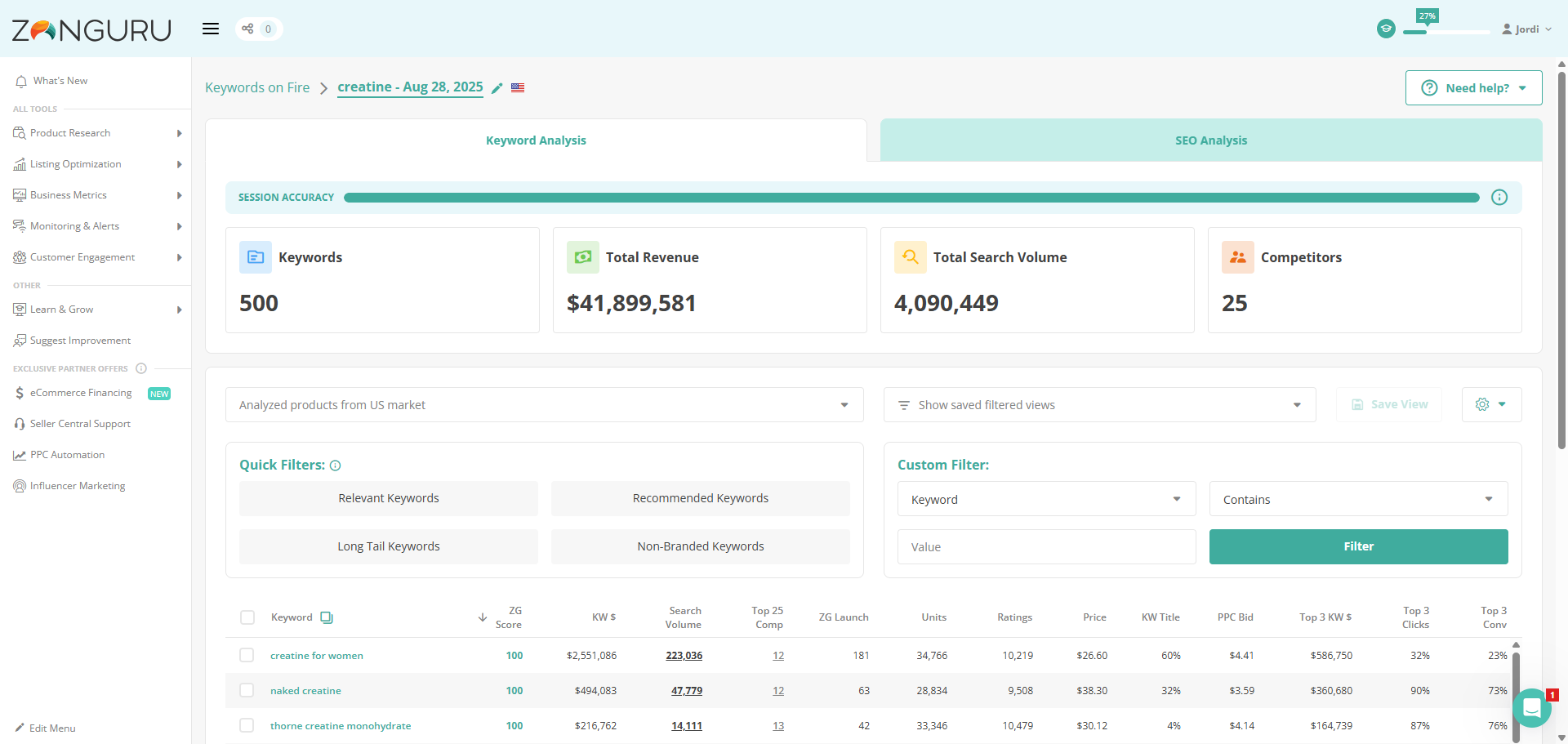

9. ZonGuru

ZonGuru offers a suite of connected tools that help Amazon sellers find profitable products, optimize listings, and manage growth in one system. Its Niche Finder identifies new product ideas quickly, while “Keywords on Fire” uncovers high-converting terms that drive sales for competitors. The Listing Optimizer then helps users refine titles, images, and keywords using live marketplace data. Altogether, these tools support sellers through the entire product analysis process – from spotting gaps to improving visibility.

What makes ZonGuru stand out is its mix of product research and customer engagement features. It doesn’t stop at finding what to sell; it also provides ways to monitor business performance and automate communication with buyers. Sellers can measure category trends, track their listings’ health, and maintain customer relationships without switching platforms. The interface is straightforward and practical, which suits both new sellers and agencies managing multiple accounts.

Key Highlights:

- Niche Finder for identifying new product opportunities

- Keywords on Fire for competitor keyword research

- Listing Optimizer powered by AI-driven insights

- Built-in business monitoring and customer communication tools

- Simple UI with data accuracy from official Amazon and Alibaba sources

Best For:

- Sellers researching new niches or product ideas

- Agencies managing listing optimization and keyword strategy

- Teams wanting both research and communication in one tool

- Beginners who need a guided approach to product analysis

Contacts:

- Website: www.zonguru.com

- Facebook: www.facebook.com/zonguru

- Instagram: www.instagram.com/zonguru

10. Viral Launch

Viral Launch combines product discovery, market intelligence, and competitor tracking into one connected platform. Its tools help sellers evaluate product potential, monitor trends, and measure competition across categories. With modules like Product Discovery and Market Intelligence, users can compare ideas, assess seasonality, and understand pricing patterns before listing anything. It’s designed to take a lot of the uncertainty out of the research process by focusing on data that actually matters for decision-making.

Beyond research, Viral Launch also includes optimization tools like Listing Analyzer and AdSprout for PPC automation. These features help sellers fine-tune their listings and monitor ad performance without relying on external apps. The overall workflow supports every stage of selling: from identifying new opportunities to improving existing listings. It’s a practical choice for sellers who want detailed insights but prefer a single environment to manage everything.

Key Highlights:

- Product Discovery and Market Intelligence for finding viable products

- Competitor tracking and category analysis

- Listing Analyzer and Builder for performance optimization

- PPC automation through AdSprout integration

- Connected tools covering research, ads, and listing management

Best For:

- Sellers comparing product ideas before launching

- Teams managing multiple Amazon accounts or product lines

- Users optimizing listings and ad performance in one place

- Growing sellers looking for consistent, data-based insights

Contacts:

- Website: viral-launch.com

- E-mail: [email protected]

- Facebook: www.facebook.com/virallaunchamazonsoftware

- Twitter: x.com/viral_launch

- LinkedIn: www.linkedin.com/company/viral-launch

- Instagram: www.instagram.com/viral_launch

- Address: 12110 Sunset Hills Rd Reston, VA 20190 United States

11. Keepa

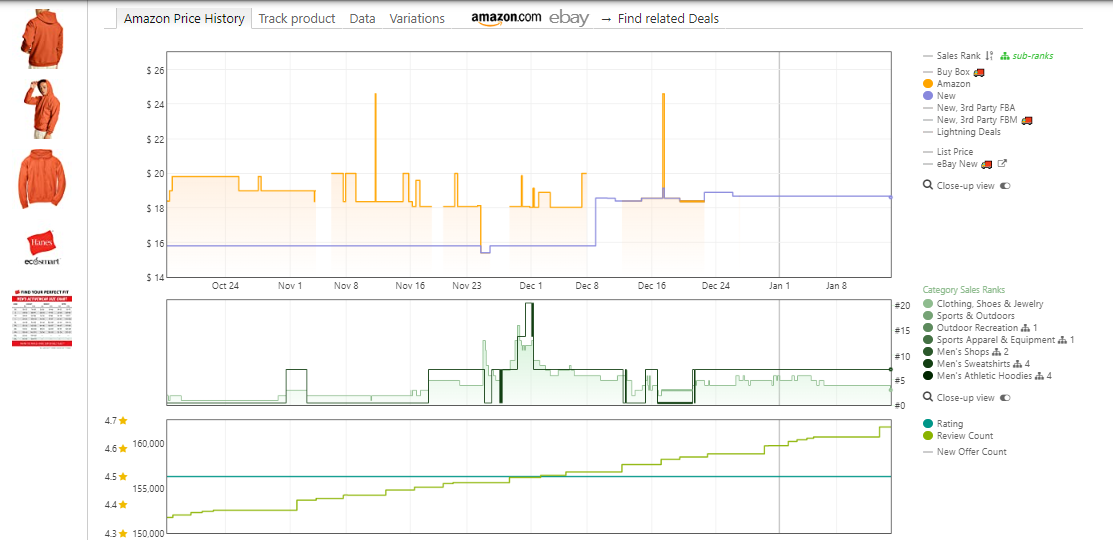

Keepa is a simple but powerful tool that helps Amazon sellers track product prices, sales rank, and historical trends. It’s best known for its price history charts, which give users a long-term view of how products perform over time. By seeing changes in pricing, discounts, and stock availability, sellers can make better decisions about when to list, restock, or adjust prices. The tool works through a browser extension and mobile app, which makes it easy to use while browsing Amazon directly.

Beyond tracking, Keepa offers data access for users who want to dig deeper into performance patterns. Its charts reveal seasonal demand and pricing stability, which is especially helpful when evaluating new product opportunities. While it’s not loaded with extra features, the simplicity is its advantage – sellers get clear, visual insights that save hours of manual research. For anyone comparing products or looking for timing cues, Keepa serves as a reliable foundation for smarter selling decisions.

Key Highlights:

- Detailed product price and sales rank tracking

- Historical charts showing trends and seasonal patterns

- Browser extension and mobile apps for quick access

- Alerts for price drops and stock changes

- Optional data access subscription for advanced analysis

Best For:

- Sellers tracking long-term product trends and pricing

- Users comparing item performance before purchasing stock

- Beginners who want a straightforward tracking tool

- Analysts looking for visual insights into market timing

Contacts:

- Website: keepa.com

- App Store: apps.apple.com/us/app/keepa-price-tracker

- Google Play: play.google.com/store/apps/keepa.mobile

- E-mail: [email protected]

- Address: Keepa GmbH, Berndorfer Str. 10 95478 Kemnath – Germany

12. ProfitGuru

ProfitGuru is built to help sellers research faster and find profitable products through automation and AI-driven insights. It combines several useful databases: products, brands, sellers, and suppliers – all in one place, so users can cross-check opportunities without jumping between platforms. Sellers can search for products under specific price ranges, evaluate demand and competition, or even analyze a competitor’s storefront to see what’s selling. It’s designed to cut down the time spent on manual checks and guesswork.

What makes ProfitGuru stand out is how it adapts to different selling models like wholesale, private label, or online arbitrage. Its tools include a bulk analysis feature for supplier lists, a reverse ASIN search to explore keyword rankings, and a bundle ideas tool that identifies products often bought together. Combined with an FBA calculator and sales estimator, it gives sellers a full picture of both opportunity and risk. Overall, it’s a practical toolkit for anyone who wants reliable Amazon data without a steep learning curve.

Key Highlights:

- Product, brand, seller, and supplier databases in one system

- Reverse ASIN and keyword research tools

- Bulk analysis for comparing supplier price lists

- FBA calculator and sales estimator for profit evaluation

- Tools for wholesale, arbitrage, and private-label models

Best For:

- Sellers running wholesale or private-label operations

- Users researching supplier options and pricing gaps

- Beginners exploring profitable niches with free access

- Teams needing an all-in-one product and keyword research setup

Contacts:

- Website: www.profitguru.com

- App Store: apps.apple.com/us/app/profitguru

- Google Play: play.google.com/store/apps/profitguru.pgapp

- E-mail: [email protected]

- Address: 1042 Fort Union Blvd, Ste #493, Midvale, UT 84047

Final Thoughts

Finding the right Amazon product analysis tool isn’t about picking the one with the longest feature list – it’s about choosing the one that fits how you actually work. Some tools help you spot new product opportunities, others dig deep into performance data, and a few bring everything together in one place. The real goal is to turn information into direction – knowing not just what to sell, but why it sells.

Every seller’s setup looks a little different, but the pattern’s the same: better data leads to better decisions. Whether you’re comparing prices with Keepa, tracking profits through Sellerboard, or using WisePPC to connect ad data with real product results, each tool gives you a different way to see your business more clearly. In a space that changes as fast as Amazon, that kind of clarity isn’t a luxury, it’s how you keep growing.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback