Analyzing Who Owns Amazon: Meet the Key Holders

Amazon, the world’s largest online retailer, has evolved into much more than just an e-commerce platform. But who actually owns this massive company? While most of us know Jeff Bezos as its founder, the ownership of Amazon is spread across many individual and institutional investors. In this article, we’ll break down who owns Amazon and how they help shape Amazon’s journey.

Who Is the Owner of Amazon, Simply Put?

Amazon is a publicly traded company, which means it’s owned by its shareholders. The largest individual shareholder is Jeff Bezos, the founder of Amazon, who still holds a significant stake. However, Amazon’s ownership is largely divided between individual investors and institutional investors. These investors include major financial firms like Vanguard, BlackRock, and Fidelity, which own substantial portions of the company.

The key takeaway here is that while Bezos remains the largest individual stakeholder, Amazon’s ownership is widespread, with institutions holding the majority of the shares.

How Much of Amazon Does the Largest Stakeholder Jeff Bezos Own?

Jeff Bezos is still Amazon’s largest individual shareholder, owning a significant portion of the company. As of 2024, Bezos owns about 9% of Amazon, which is roughly 937 million shares. Here’s a breakdown:

- Total Shares Owned: 937,774,000 shares.

- Percentage of Ownership: approximately 9% of Amazon’s outstanding shares.

- Value of His Stake: Approximately $166 billion.

Although Bezos has reduced his stake over the years, he remains deeply invested in Amazon’s long-term success, even though he stepped down as CEO in 2021.

Top Institutional Investors in Amazon

Institutional investors play a critical role in Amazon’s ownership structure. These investors manage large sums of capital and own a significant portion of the company’s outstanding shares. The involvement of these institutions is a testament to Amazon’s status as a leading global company, and their support is crucial for its growth and success. Let’s take a closer look at the largest institutional shareholders in Amazon:

Vanguard Group

Vanguard is one of the world’s largest investment management firms, holding about 7.42% of Amazon’s shares, which is approximately 771 million shares. Vanguard has a reputation for being a low-cost leader in the investment world, managing more than $7.6 trillion in assets as of 2023. It is known for its passive investment strategies, with a focus on index funds and ETFs. Vanguard’s large stake in Amazon reflects its belief in the company’s long-term growth potential. Vanguard has also been an influential shareholder, supporting Amazon’s management decisions and pushing for long-term value creation.

BlackRock

BlackRock, the largest asset manager globally, holds around 6.04% of Amazon, or approximately 627 million shares. With more than $9 trillion in assets under management, BlackRock is a dominant player in the financial world. The firm manages a wide range of investment vehicles, including iShares ETFs, and has a significant presence in both institutional and retail investment markets. BlackRock’s investment in Amazon is a reflection of its strategy to include high-growth tech stocks in its portfolio, as Amazon continues to show strong performance across its e-commerce and cloud computing segments. As a major institutional investor, BlackRock’s influence extends beyond just capital – it is a vocal advocate for corporate governance and shareholder rights.

State Street

State Street, a global financial services company, holds about 3.32% of Amazon, which is roughly 345 million shares. Headquartered in Boston, State Street manages assets worth around $3.5 trillion and is one of the largest custodial banks in the world. State Street’s investment in Amazon reflects its strategy of diversifying its portfolio with leading technology companies. Like Vanguard and BlackRock, State Street has a long-term investment horizon, seeking to maximize value for its clients by investing in high-growth companies like Amazon.

Fidelity Management & Research

Fidelity Management & Research owns approximately 3.04% of Amazon, or about 316 million shares. Fidelity is a privately held financial services firm that has been a staple in the investment industry for decades. It is well-known for its array of mutual funds, retirement products, and actively managed funds. Fidelity’s involvement in Amazon is indicative of its focus on companies with substantial long-term growth potential. As one of the largest providers of retirement accounts and managed funds, Fidelity’s stake in Amazon contributes to its diversified portfolio of high-performing companies.

T. Rowe Price

- Rowe Price holds about 1.85% of Amazon, which equals about 192 million shares. Based in Baltimore, T. Rowe Price is a publicly traded financial services firm with nearly $1.51 trillion in assets under management. The firm is known for its long-term, active investment strategies and its focus on generating above-market returns through careful stock selection. T. Rowe Price has historically been a significant investor in growth stocks, and its large position in Amazon demonstrates its confidence in the company’s ability to continue expanding and outperforming its competitors. T. Rowe Price’s stake in Amazon is a reflection of its commitment to supporting companies with sustainable business models and strong growth prospects.

These institutional investors – Vanguard, BlackRock, State Street, Fidelity, and T. Rowe Price – are some of the biggest players in Amazon’s shareholder base. Collectively, they own a significant portion of Amazon’s outstanding shares and provide valuable support for the company’s continued growth and development.

The Role of Amazon’s Top Management in Its Ownership Structure

While institutional investors hold the majority of Amazon’s shares, the company’s top management also has significant stakes, aligning their financial interests with Amazon’s success. Here’s a look at the key leaders:

- Jeff Bezos: Amazon’s founder and largest individual shareholder, owning about 9.02% of Amazon (937 million shares). He remains Executive Chairman and continues to influence the company’s strategy.

- Andrew Jassy: The current CEO, holding around 2 million shares. Jassy has been with Amazon since 1997 and played a key role in growing AWS, Amazon’s cloud division.

- Douglas Herrington: CEO of Worldwide Amazon Stores, with nearly 523,000 shares. He has been with Amazon since 2005, shaping its retail and grocery operations.

- Adam Selipsky: CEO of AWS, owning about 134,000 shares. Selipsky helped grow AWS into a major revenue source for Amazon.

- Shelley Reynolds: Vice President of Worldwide Controller, holding approximately 122,000 shares. Reynolds has overseen Amazon’s financial operations for many years.

These leaders not only guide Amazon’s direction but also have a vested interest in its growth, ensuring alignment with the company’s long-term success.

How Institutional Ownership Influences Amazon’s Growth

Institutional ownership has a major impact on Amazon’s financial strategies and long-term success. With nearly 63% of Amazon’s shares held by institutional investors, their influence is substantial. The involvement of these investors provides both financial strength and strategic direction, which is crucial for Amazon’s continued growth and market leadership. Here are key ways institutional ownership influences Amazon’s growth:

Financial Stability and Resources

Institutions like Vanguard and BlackRock provide Amazon with the financial stability needed for large-scale projects and long-term initiatives. Their significant investments give Amazon the ability to fund new ventures, expand its business operations, and weather market fluctuations. This support allows Amazon to stay focused on growth while ensuring it has the necessary resources to drive innovation across its business segments.

Focus on Long-Term Growth

Institutional investors are focused on Amazon’s future expansion, which encourages the company to innovate in key areas such as e-commerce, cloud computing, and artificial intelligence (AI). These investors have a long-term investment horizon, which aligns with Amazon’s strategy of reinvesting profits to drive future growth rather than focusing solely on short-term returns.

Shareholder Advocacy

Institutional investors often advocate for decisions that align with their long-term growth strategies. They encourage Amazon’s leadership to make strategic choices that keep the company competitive and resilient, even in rapidly changing markets. This advocacy includes pushing for transparency, governance improvements, and ensuring that the company’s priorities align with maximizing shareholder value.

This significant institutional presence reinforces Amazon’s position as a solid long-term investment, ensuring continued progress and strategic direction.

The Impact of Amazon’s Public Listing on Its Shareholders

Amazon’s decision to go public in 1997 marked a significant shift in its ownership structure. Initially starting as a private venture, Amazon’s IPO allowed it to raise capital and attract a diverse range of investors. Here’s how the public listing impacted Amazon’s shareholders:

- Wider Ownership Base: Going public enabled Amazon to have millions of shareholders, both individual and institutional.

- Stock Liquidity: The public offering provided liquidity, allowing shareholders to buy and sell shares on the open market.

- Capital for Growth: The capital raised from its IPO allowed Amazon to invest heavily in its infrastructure, tech, and logistics, fueling its expansion into new markets.

Amazon’s public listing gave it the financial flexibility to grow rapidly, turning it into one of the most valuable companies globally.

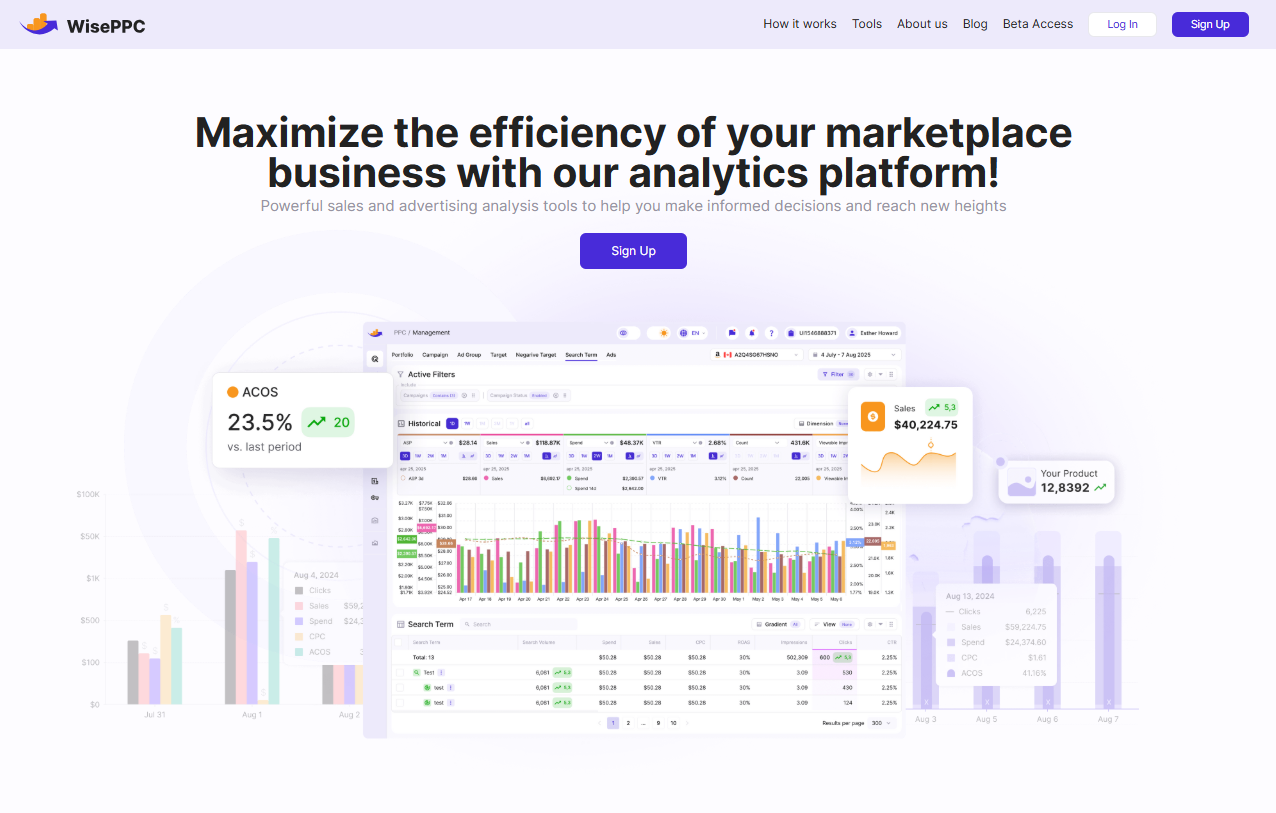

WisePPC: Optimizing Advertising and Sales Performance

At WisePPC, we offer a comprehensive toolkit designed to help businesses enhance their advertising strategies and boost sales performance across marketplaces like Amazon. Our platform focuses on providing advanced analytics, real-time performance tracking, and automated optimizations – all in one integrated system. Whether you’re managing a small or large-scale business, we at WisePPC give you the tools to drive growth, reduce wasted ad spend, and make informed, data-driven decisions.

We empower businesses with detailed insights into ad performance, sales metrics, and more. Our platform simplifies campaign management, bid optimization, and trend analysis, helping you make smarter marketing decisions that support long-term success. With the latest technology, we help businesses operate more efficiently and effectively across various sales channels.

Features and Services Offered by WisePPC

Bulk Actions for Efficient Campaign Management

We allow our users to make changes to multiple campaigns, ad groups, or targets simultaneously. With just a few clicks, you can pause, adjust budgets, or optimize bids, saving significant time on repetitive tasks.

Advanced Filtering for Deep Analysis

Our platform offers powerful filtering options that allow you to segment and analyze campaign performance data across a range of metrics. This enables precise data selection and in-depth optimization.

Long-Term Historical Data Storage

We store historical data for years, unlike Amazon, which only retains 60-90 days of performance data. This gives you the ability to track trends, analyze seasonality, and make better decisions based on long-term insights.

Placement Performance Analysis

With WisePPC, you can track performance at multiple placement levels, such as campaigns, ad groups, and keywords. This allows you to fine-tune your bidding strategies and maximize your return on ad spend.

At WisePPC, we provide powerful, user-friendly tools that help businesses manage campaigns, analyze metrics, and optimize advertising strategies with ease. Our platform is ideal for businesses looking to scale effectively and make smarter marketing decisions.

Conclusion

In conclusion, Amazon’s ownership is divided among a mix of individual stakeholders, with Jeff Bezos remaining the largest individual shareholder, and a significant portion held by institutional investors like Vanguard, BlackRock, and State Street. These institutional investors play a major role in Amazon’s financial strategies and growth, providing stability and resources for long-term success. Meanwhile, Amazon’s top management, including the current CEO Andrew Jassy and other key executives, maintain substantial stakes, aligning their interests with the company’s future. This blend of individual and institutional ownership ensures that Amazon continues to thrive as one of the world’s most valuable and influential companies.

FAQ

1. Who owns the largest share of Amazon?

The largest shareholder of Amazon is its founder Jeff Bezos, who owns about 9% of the company, equating to around 937 million shares.

2. Are institutional investors involved in Amazon’s ownership?

Yes, institutional investors own nearly 63% of Amazon’s shares, with major firms like Vanguard, BlackRock, and State Street holding substantial portions of the company.

3. How much of Amazon does Jeff Bezos own?

Jeff Bezos owns nearly 9.02% of Amazon, approximately 937 million shares, making him the largest individual shareholder of the company.

4. Who else in Amazon’s leadership holds shares?

In addition to Bezos, Andrew Jassy, the CEO of Amazon, owns around 2 million shares. Other executives like Douglas Herrington and Adam Selipsky also have significant stakes in the company.

5. How does Amazon’s ownership structure affect its business?

Amazon’s ownership structure, combining the influence of institutional investors and top management, helps drive stability, innovation, and long-term growth. The interests of shareholders align with the company’s success, supporting strategic decisions that propel Amazon forward.

6. What role do institutional investors play in Amazon?

Institutional investors provide Amazon with financial resources and stability. Their focus on long-term growth pushes the company to innovate in areas like e-commerce, cloud computing, and AI, ensuring continued success.

7. How does Amazon’s public listing impact its ownership?

Going public in 1997 allowed Amazon to raise capital and expand its shareholder base. This shift enabled millions of investors to own a stake in Amazon, contributing to the company’s rapid growth and global dominance.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback