Best Sellics Alternatives to Manage Your Ads and Data Smarter

If Sellics hasn’t been hitting the spot for you lately, you’re not the only one. Some sellers want more flexibility, others need deeper insights, and plenty just want a platform that makes day-to-day work a little less clunky. Luckily, there are now a handful of tools that approach ad management and marketplace data in different ways. Here’s a look at some options that might fit better with how you actually run your business.

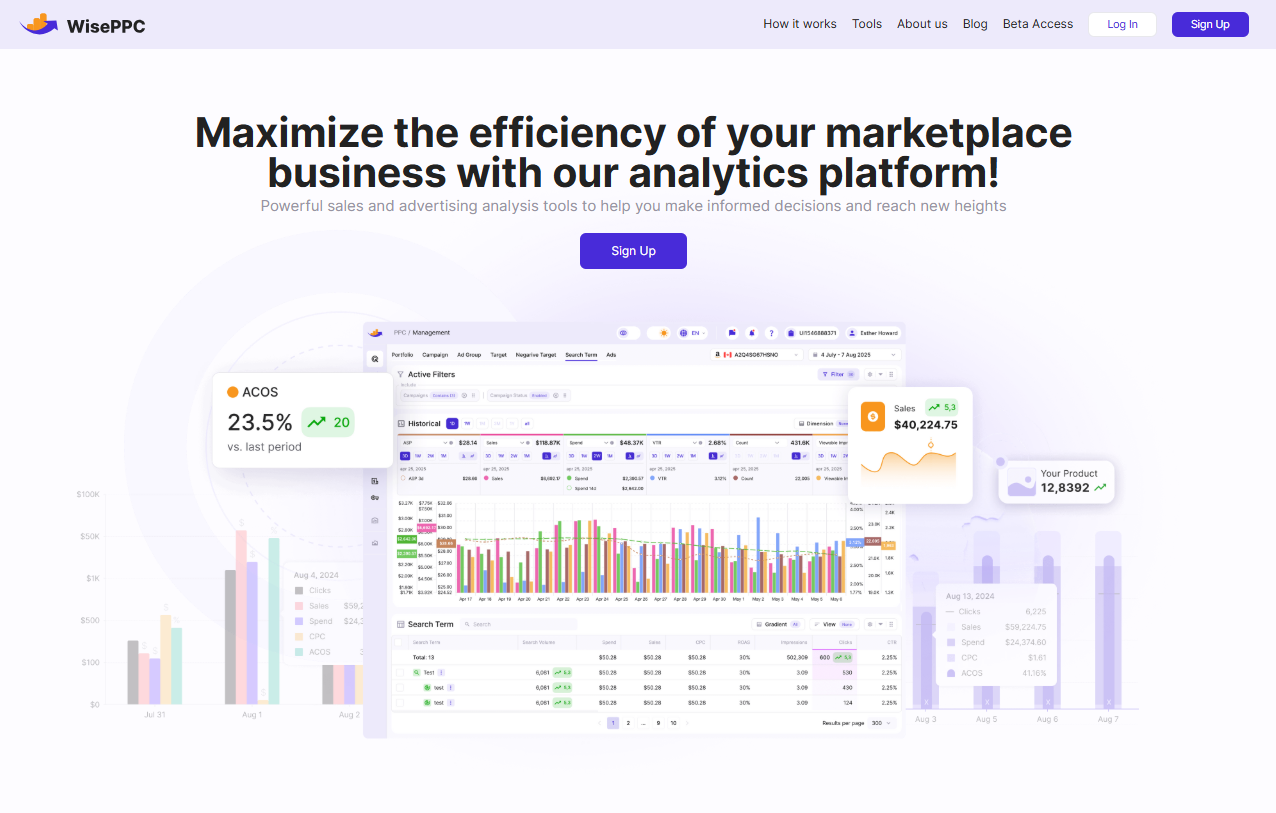

1. Wiseppc

WisePPC is our answer to the frustration of juggling spreadsheets and clunky dashboards. Instead of exporting data every week, we connected everything directly to Amazon and Shopify so we can monitor performance in one place. Adjusting bids, budgets, or keywords doesn’t require digging through menus-we do it all inline, without switching tabs.

One of the biggest differences from Sellics is how we handle data history. While Amazon’s default view only covers a couple of months, WisePPC stores years of performance data. That gives us the ability to track seasonal shifts, compare year-over-year trends, and revisit old campaigns when planning new ones. For sellers like us who want more control over bulk edits, stronger filters, and a clearer view of campaign evolution, WisePPC is built with those needs in mind.

Key Highlights:

- Historical data stored well beyond Amazon’s 60-90 days

- Bulk editing for thousands of campaigns at once

- Real-time metrics like ACOS, TACOS, and CTR

- Inline edits without leaving the main dashboard

- Gradient highlighting to flag performance outliers

- Multi-account dashboard (in development)

- Visual charts with multiple metrics

Who it’s best for:

- Sellers moving away from Sellics who want deeper controls

- Teams handling large ad portfolios that need batch editing

- Agencies looking for more flexibility in optimization

- Brands running both Amazon and Shopify

Marketers who plan campaigns around long-term data

Contact and Social Media Information:

- Website: wiseppc.com

- LinkedIn: www.linkedin.com/company/wiseppc

- Instagram: www.instagram.com/wiseppc

- Facebook: www.facebook.com/people/Wise-PPC/61573154427547

2. Webgility

Webgility takes a different angle by focusing on accounting and inventory automation for ecommerce. It’s particularly useful for QuickBooks users who want tighter control over bookkeeping and order tracking. Instead of reconciling sales data manually, the platform syncs transactions and inventory across channels in real time.

They’ve also added AI tools for reporting and automating repetitive tasks. That means less time chasing down spreadsheets and more accurate margins without extra manual work. If you’re leaving Sellics because ad metrics aren’t the only challenge, Webgility covers the operational side that often gets overlooked.

Key Highlights:

- Real-time syncing with QuickBooks and ecommerce sites

- AI tools to automate financial and reporting tasks

- Detailed profit and SKU-level reporting

- Automated reconciliation and inventory tracking

- Guided onboarding and ongoing support

Who it’s best for:

- Sellers who prioritize financial accuracy

- Businesses looking to automate accounting work

- Ecommerce teams replacing Sellics with ops-focused tools

- QuickBooks users needing deeper integration

Contact and Social Media Information:

- Website: webgility.com

- Address: 1111 6th Ave STE 550 San Diego, CA 92121

- Phone: +1 (877) 753-5373

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/webgility

- Instagram: www.instagram.com/webgilityinc

- Facebook: www.facebook.com/webgility

3. A2X

A2X focuses on ecommerce accounting, specifically reconciling revenue from Amazon, Shopify, and Etsy with accounting platforms like QuickBooks and Xero. It takes raw payout data and organizes it into summaries that match deposits, taxes, and expenses in your books.

For teams who struggle with tax prep or want more clarity on profits and cost of goods, A2X helps turn messy financial records into something usable. If what you really need after Sellics is a cleaner view of finances instead of ad metrics, this is the kind of tool that makes that process less painful.

Key Highlights:

- Auto-categorized summaries tied to accounting deposits

- Works with Amazon, Shopify, eBay, Etsy, Walmart, and more

- Connects to QuickBooks, Xero, Sage, and NetSuite

- Tax rules included in transaction processing

- Global support team for ecommerce accounting

Who it’s best for:

- Sellers shifting to accounting-focused tools

- Teams working across multiple sales channels

- Bookkeepers who want automated reconciliation

- Businesses preparing for tax season

Contact and Social Media Information:

- Website: a2xaccounting.com

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/a2x-for-ecommerce

- Twitter: x.com/a2xaccounting

- Facebook: facebook.com/a2xaccounting

4. Teikametrics

Teikametrics is built around AI-driven ad optimization across Amazon, Walmart, and similar marketplaces. Their platform automatically adjusts bids, forecasts inventory needs, and fine-tunes campaigns using machine learning.

They also provide Smart Pages for listing optimization and have expanded into social shopping integrations. Compared to Sellics, it’s more automated-you set goals, and the system handles the adjustments. For teams managing high ad spend, that hands-off approach can be a big time saver.

Key Highlights:

- AI-based bidding and campaign automation

- Inventory forecasting and stock tools

- Smart Pages for listings

- Real-time analytics and performance tracking

- Managed services for extra support

Who it’s best for:

- Sellers running complex ad accounts

- Teams who want to automate routine work

- Businesses looking for advanced AI tools

- Users active across Amazon and Walmart

Contact and Social Media Information:

- Website: teikametrics.com

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/teikametrics

- Twitter: x.com/Teikametrics

- Facebook: www.facebook.com/Teikametrics

5. Helium 10

Helium 10 offers a full suite for Amazon and Walmart sellers. It covers keyword research, product tracking, ad management, listing optimization, and more. Users can focus on specific tasks, like ad automation or refund tracking, or layer tools together as their business grows.

It’s flexible in how you use it-some sellers stick with the research tools, others build it into their daily ad management. With new integrations like TikTok, it’s also branching into newer sales channels.

Key Highlights:

- Product research and keyword tracking

- AI tools for ad optimization and listings

- Inventory management with alerts

- FBA reimbursement and refund tracking

- Chrome extension for quick insights

Who it’s best for:

- Amazon sellers focused on expansion

- Teams who want flexibility as they scale

- Users managing sales across different platforms

- Businesses that rely on data-backed research

Contact and Social Media Information:

- Website: helium10.com

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/helium10

- Instagram: www.instagram.com/helium10software

- Twitter: x.com/H10Software

- Facebook: www.facebook.com/Helium10Software

6. Jungle Scout

Jungle Scout is another Amazon-focused platform, but it leans more toward product and market research. It helps with sourcing, inventory management, ad tracking, and even offers a supplier database.

They’ve built different tiers of service so both new sellers and larger brands can use the same system. Compared to Sellics, it places more weight on research and long-term planning, making it a fit for those who want to strategize rather than just react to daily ad numbers.

Key Highlights:

- Product and keyword research tools

- Supplier database access

- Listing optimization and review automation

- Ad performance tracking

- Plans for both beginners and enterprises

Who it’s best for:

- New sellers on Amazon

- Teams building brand-level strategies

- Businesses focused on sourcing and supply chains

- Users who need historical data for planning

Contact and Social Media Information:

- Website: junglescout.com

- Address: 328 S Jefferson St, Suite 1030, Chicago, IL 60661

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/junglescout

- Instagram: www.instagram.com/junglescout_

- Twitter: x.com/junglescout

- Facebook: www.facebook.com/amazonjunglescout

7. DataHawk

DataHawk is designed for teams that want full visibility into their marketplace performance across platforms like Amazon and Walmart. What separates it from tools like Sellics is its emphasis on bringing together multiple data sources into one centralized platform, giving users a cleaner, more customizable way to monitor ad performance, sales trends, and inventory forecasting. Their approach leans heavily into AI-powered insights, daily performance alerts, and clean dashboards built for larger brands and agencies.

For companies that want flexibility, DataHawk allows you to connect your preferred analytics tools, export your own data, and avoid the common issue of vendor lock-in. It’s structured more like an open analytics workspace than a traditional ad dashboard, which might be a better fit for teams looking for something that goes deeper than just campaign metrics. Sellics users looking to break away from fixed reporting formats and get a broader view of marketplace operations may find what they need here.

Key Highlights:

- Unified data from Amazon, Walmart, and other marketplaces

- AI-generated alerts and performance insights

- Custom dashboards with BI integrations like Power BI and Looker

- Historical tracking and export-ready datasets

- Full data ownership with no lock-in

Who it’s best for:

- Large sellers needing a customizable analytics environment

- Teams moving away from Sellics due to data limitations

- Agencies running multi-account marketplace operations

- Businesses looking for AI-supported growth and forecasting tools

Contact and Social Media Information:

- Website: datahawk.co

- Address: 43 boulevard de magenta 75010 Paris

- LinkedIn: www.linkedin.com/company/datahawk-technologies

- Facebook: www.facebook.com/datahawkco

- Twitter: x.com/datahawkco

8. Perpetua

Perpetua focuses specifically on optimizing retail media and ad spend across platforms like Amazon and Walmart. Where Sellics combines campaign data with broader metrics, Perpetua builds around automation and campaign goals. Users don’t have to set up campaigns manually. Instead, they enter their targets, and Perpetua’s ad engine handles everything from budget management to bid adjustments in real time. It’s structured for people who want to spend less time inside ad dashboards and more time reviewing outcomes.

It also includes customizable reporting tools and market intelligence views to help brands understand the bigger picture behind their ad results. While it may feel more hands-off compared to Sellics, Perpetua still offers transparency and control over key levers. It could be a good match for brands that want a simpler, cleaner way to scale campaign performance without needing to micromanage every detail.

Key Highlights:

- Goal-based ad automation and optimization

- Campaign execution for search, display, and video ads

- Marketplace support including Amazon and Walmart

- Custom reporting and retail market analysis tools

- Smart budget adjustments and contextual bidding

Who it’s best for:

- Brands replacing Sellics with a more automated ad solution

- Teams managing high-volume campaign operations

- Agencies running sponsored product, brand, and DSP ads

- Sellers who want AI-backed execution with minimal setup

Contact and Social Media Information:

- Website: perpetua.io

- Address: 36 Maplewood Ave, Portsmouth, NH 03801, United States

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/perpetua-labs

- Instagram: www.instagram.com/perpetua.io

- Twitter: x.com/PerpetuaLabs

- Facebook: www.facebook.com/perpetualabs

9. Viral Launch

Viral Launch focuses on helping Amazon sellers plan, launch, and scale their product strategies. Compared to Sellics, Viral Launch leans more into product research, keyword analysis, and listing optimization. The platform includes tools like market intelligence, competitor tracking, keyword research, and a listing builder. While it has some overlap with ad-related features, its real strength lies in helping sellers decide what to sell and how to position it.

For sellers who feel limited by Sellics when it comes to early-stage research or listing setup, Viral Launch offers a more in-depth starting point. It’s especially useful for teams that want to identify trends, evaluate market opportunities, and optimize their listings for visibility before turning to ad spend. It doesn’t aim to be a full campaign manager but instead complements ad platforms with solid pre-launch and listing tools.

Key Highlights:

- Product research tools with market insights

- Keyword research and rank tracking

- Competitor tracking and listing analysis

- Listing optimization with AI content suggestions

- Tools for Walmart sellers also available

Who it’s best for:

- Sellers who want stronger research tools than Sellics offers

- Brands launching new products in competitive niches

- Teams focused on listing optimization and visibility

- Sellers who need a foundation before investing in ads

Contact and Social Media Information:

- Website: viral-launch.com

- Address: 12110 Sunset Hills Rd Reston, VA 20190 United States

- LinkedIn: www.linkedin.com/company/viral-launch

- Instagram: www.instagram.com/viral_launch

- Twitter: x.com/viral_launch

- Facebook: www.facebook.com/virallaunchamazonsoftware

10. SellerApp

SellerApp combines PPC automation, ad management, and marketplace analytics in one dashboard, giving teams more control over how they manage and measure campaign performance. Compared to Sellics, it goes a bit deeper into automation and strategy execution. Users can set up AI-driven rule-based campaigns, track marketplace trends, and monitor profit at the ASIN level, which is helpful for understanding what’s working and what needs adjustment.

They also offer account management and support for sellers who want help making data-backed decisions or managing campaigns across different Amazon geographies. If you’re looking for something that pairs hands-on services with self-serve automation, SellerApp might be a good shift from Sellics. It’s not just about data dashboards – it’s about putting the insights to work through guided strategy and execution.

Key Highlights:

- AI-based rule automation for Amazon PPC

- Centralized dashboard across ad campaigns and listings

- Profit tracking with real-time reporting

- Managed services and agency support

- Tools for keyword research, audit, and product intelligence

Who it’s best for:

- Sellers replacing Sellics with deeper PPC management

- Teams that want both automation and expert input

- Agencies managing multiple client accounts

- Businesses scaling across Amazon marketplaces

Contact and Social Media Information:

- Website: www.sellerapp.com

- Address: 4819 Bryant Mdws Dr, Spring, TX 77386, United States

- Phone: +1-256-363-0567

- E-mail: [email protected]

- LinkedIn: www.linkedin.com/company/sellerapp

- Instagram: www.instagram.com/sellerapp_insta

- Twitter: x.com/SellerApp_Inc

- Facebook: www.facebook.com/sellerapp

11. ZonGuru

ZonGuru offers a toolkit designed by Amazon sellers for other sellers, which gives it a practical feel. Its focus is on research, listing optimization, customer engagement, and business tracking. Tools like Keywords on Fire and Listing Optimizer aim to simplify the process of ranking higher and keeping listings sharp, while customer email features help maintain relationships after the sale.

Unlike Sellics, which leans heavily on ad and profit tracking, ZonGuru adds more seller-focused elements like niche discovery and customer communication. It’s a platform that tries to cover both the growth and maintenance side of Amazon businesses, making it easier to move from early product selection to ongoing scaling.

Key Highlights:

- Product and niche research tools

- AI-powered listing optimizer with ChatGPT integration

- Keyword insights through Keywords on Fire

- Business dashboards for performance tracking

- Customer engagement and email automation

Who it’s best for:

- Sellers who want research and optimization in one place

- Agencies working with multiple Amazon clients

- Entrepreneurs seeking accurate keyword and niche data

- Sellers who need built-in customer communication tools

Contact and Social Media Information:

- Website: www.zonguru.com

- Instagram: www.instagram.com/zonguru

- Facebook: www.facebook.com/zonguru

Conclusion

The right Sellics alternative depends on what part of your workflow feels the most limiting. Some tools go deep on ads, others on accounting, and a few help with product data or SEO instead. What matters is matching the tool to the gap Sellics left in your process.

If you’re tired of short data windows, endless tab-switching, or clunky interfaces, try a platform that cuts those pain points down. Whether that’s bulk edits, better financial clarity, or simply fewer spreadsheets, there’s likely an option here that makes your daily work a little easier.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback