How Much Does Amazon Make a Day? The 2025 Breakdown

It’s hard to wrap your head around just how big Amazon really is until you see the numbers. Every minute, the company pulls in more revenue than many small businesses earn in a year. And by the end of the day? We’re talking about billions – with a B.

But it’s not just about raw sales. Amazon’s daily earnings are the result of dozens of revenue streams working in sync – from cloud computing and advertising to subscriptions and third-party seller fees. In this article, we’re breaking down exactly how much Amazon makes in a day, what drives those numbers, and why it’s not as simple as it looks at first glance.

Why Daily Revenue Matters More Than Just “Annual Reports”

Annual reports are great for Wall Street analysts, but if you want to understand the pace at which Amazon operates, daily revenue tells a much clearer story. Amazon’s operations are a 24/7 machine, processing over 66,000 orders every hour and generating over $15,000 every single second.

A company this big doesn’t just make money – it moves money faster than most small countries.

The Big Number: Amazon’s Estimated Daily Revenue in 2025

Most recent estimates put Amazon’s daily revenue at approximately $1.5 billion per day. Some sources suggest slightly lower ($1.29 billion), while others round higher based on growth patterns and Prime Day spikes. Here’s a quick breakdown of what that looks like at different scales:

- Per hour: $62.5 million.

- Per minute: $1.04 million.

- Per second: $17,300.

These numbers fluctuate depending on seasonal trends (like Prime Day), global markets, and advertising demand, but they give us a pretty good average to work with.

Revenue vs. Profit: What Amazon Actually Keeps

Here’s where it gets interesting. Despite pulling in more than $1.5 billion daily, Amazon’s profit margins are surprisingly thin in many areas.

- Estimated daily profit: Roughly $83 million.

- Profit per minute: Around $57,800.

- Profit margin (overall): Over 10%, depending on the year.

This means that out of every dollar Amazon earns, it keeps just a few cents. The rest goes to infrastructure, logistics, tech, salaries, and more. If you’re wondering why, it’s because Amazon’s strategy has always been about scale, not big margins.

Retail Sales Still Lead the Pack

Amazon’s own product sales still account for the biggest chunk of daily revenue – roughly $677 million every day. That includes everything the company sells directly through its massive network of warehouses, from Alexa devices to books to batteries. But while the sales volume is huge, the margins are thin. Between shipping costs, returns, and customer service, this part of the business runs at high speed but low profit.

The Third-Party Marketplace That Feeds Itself

Now here’s where things get more profitable. Third-party sellers make up over half of all sales on Amazon, and the platform takes a cut from almost every move they make. Whether it’s storage fees, fulfillment charges, or ad spend, Amazon earns about $428 million a day just from supporting these sellers. And because Amazon isn’t holding the inventory or managing the risk, this revenue stream is much leaner and more scalable than retail.

AWS: The Cloud That Prints Money

Amazon Web Services is like the quiet genius in the back room. It doesn’t get the flashy front-page treatment, but it brings in about $200 million per day, and is a good chunk of Amazon’s actual profit. The margins here are some of the highest in the entire business, and AWS has quietly become the backbone of the modern internet, powering everything from startups to government systems.

Ads That You Didn’t Know Were Ads

Search for a product on Amazon, and the first few results you see are probably paid placements. That’s Amazon Ads at work, a growing machine that now earns the company $38 million a day. And it’s not just basic ads – there’s a whole system of sponsored listings, display placements, and brand-building tools baked into the platform. Sellers pay for visibility, and Amazon profits from the competition.

Prime and Everything That Comes With It

Amazon Prime isn’t just a loyalty program – it’s a revenue engine. At $139 a year, it may seem modest, but across millions of members, it adds up to about $121.6 million per day. That includes not just the subscription fees, but also the increased spending Prime members tend to do. Plus, you’ve got related services like Audible, Kindle Unlimited, and Amazon Music all feeding into this bucket.

Online Sales: Still the Core, But Not the Cash Cow

Amazon sells over 12 million products directly – from diapers to smart speakers. This part of the business still drives the largest chunk of daily revenue. But because of high operating costs (warehousing, shipping, returns, customer support), profit margins in retail remain incredibly thin – sometimes as low as 2-3%.

So even though it accounts for nearly half of Amazon’s revenue, retail alone doesn’t pay the bills.

When the Revenue Really Jumps: Prime Day’s Massive Spike

Most days, Amazon’s revenue hums along at around $1.5 billion. But when Prime Day rolls around? That number doesn’t just climb – it leaps. In 2024 alone, Prime Day pulled in a staggering $14.2 billion in total sales across its two-day window. That breaks down to about $7.1 billion per day, nearly five times Amazon’s usual pace.

What’s fueling that surge? A big part of it is third-party sellers. They accounted for roughly 60% of Prime Day’s total haul, which tells you everything you need to know about how central the marketplace has become to Amazon’s business model. These aren’t just “supporting characters” anymore – they’re driving the plot.

And while Black Friday and Cyber Monday still deliver impressive numbers, they don’t quite hit the same peak. Prime Day has evolved into a revenue powerhouse in its own right, growing faster year over year and proving that Amazon doesn’t need the traditional holiday calendar to turn on the jets.

For sellers, it’s a high-stakes, high-reward moment. For Amazon? It’s a reminder that they can flip a switch, and add billions to the books, just by creating their own holiday.

The Real Costs Behind the Scenes

Amazon’s empire isn’t cheap to run. The costs of shipping millions of packages, operating thousands of facilities, and maintaining a workforce of over 1.5 million people adds up fast.

Major expenses include:

- Fulfillment center operations.

- Employee wages and benefits.

- Tech and AWS infrastructure.

- Logistics and delivery (including Prime one-day shipping).

- Customer service.

- Original content for Prime Video.

- AI, automation, and robotics investment.

All of this is why, despite the huge revenue, profit margins can be surprisingly narrow.

What Drives Daily Growth: Mobile, International, and Cloud

Amazon’s growth isn’t just coming from the U.S. North America still accounts for about $700 million/day, but international markets now bring in another $590 million daily.

Drivers of this growth include:

- Mobile shopping (25M+ app downloads monthly).

- Expansion into new regions (India, Middle East, Latin America).

- AWS adoption across the globe.

- Subscription growth.

- Increased ad spend from third-party sellers.

Profitability Lessons for Business Owners

There’s a lot entrepreneurs can learn from how Amazon makes money daily:

Don’t Put All Your Revenue in One Basket

One of Amazon’s biggest strengths is how it spreads out its income. Retail, cloud services, ads, subscriptions, seller fees – each part contributes to the whole. If one area slows down, another picks up the slack. For entrepreneurs, the takeaway is simple: build more than one way to make money. Whether it’s offering a subscription, launching a service arm, or monetizing content, diversification gives your business breathing room.

Volume Can Beat Margins

Amazon’s retail margins are razor-thin – sometimes just 2% to 3% – yet the company still posts massive profits. Why? Volume. When you’re moving millions of orders a day, even a few cents per item adds up. While you may not be dealing in Amazon-scale numbers, the principle holds: low margins aren’t a dealbreaker if you’ve got strong demand and efficient systems behind you.

Subscription Models Aren’t Just About Revenue

Prime isn’t just a $139-per-year membership – it’s a behavior shift. Members shop more often, spend more per visit, and are less likely to jump to a competitor. That’s the real value. If your business can find a way to introduce membership perks, loyalty programs, or recurring services, you’re not just locking in revenue – you’re shaping how customers interact with your brand.

Infrastructure Builds Advantage Over Time

Amazon’s warehouses, delivery network, and backend systems didn’t appear overnight. They were expensive, time-consuming, and often built before they were profitable. But now? They’re a competitive moat. For smaller companies, this might mean investing in automation, better software, or even a tighter supply chain. The return may not be immediate, but it compounds.

Reinvesting Is a Strategy, Not a Sacrifice

Amazon rarely hoards cash. Instead, it plows earnings back into AI development, warehouse robotics, faster shipping models, and new business lines. That constant reinvestment is what keeps it ahead. If you’re running a business, resist the urge to sit comfortably on profits. The smartest move may be putting that money back to work, especially if it makes your operation leaner, faster, or more scalable over time.

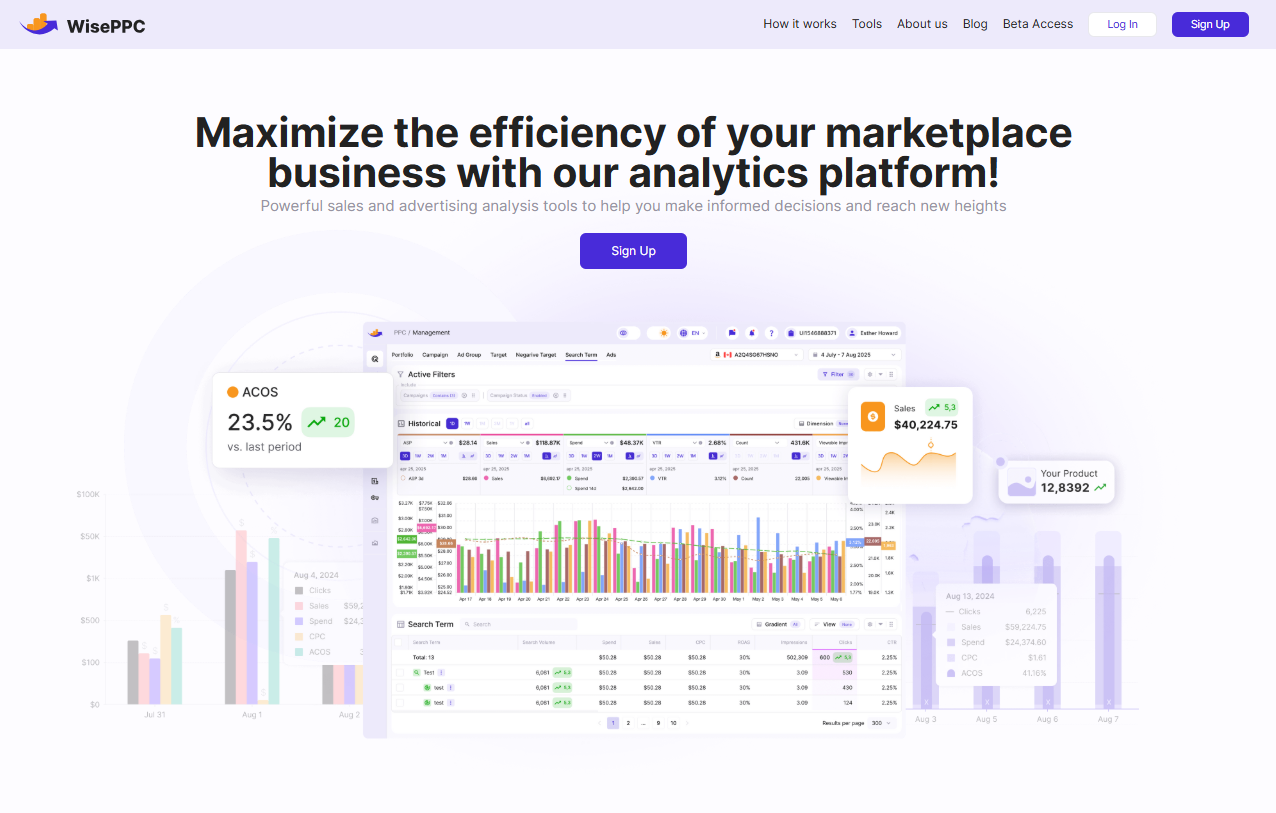

How WisePPC Helps Brands Win on Amazon, One Metric at a Time

At WisePPC, we work behind the scenes of Amazon’s massive daily revenue engine. As an Amazon Ads Verified Partner, we help sellers tap into the same systems that fuel Amazon’s billions, giving them the data clarity and campaign control they need to scale. Our platform is built for sellers who want to go beyond the guesswork and actually see what’s driving results, whether that’s ad spend, organic sales, or something hidden in the fine print.

We’ve seen firsthand how ads and third-party tools now play a major role in Amazon’s daily income. That’s why we focus on giving sellers deep insights across both paid and organic performance, with flexible dashboards, real-time tracking, and automation that saves hours of manual work. Whether you’re managing ten products or a thousand, WisePPC helps you run smarter – not harder.

The truth is, Amazon’s revenue success isn’t just about having the marketplace – it’s about having the tools to make sense of it. That’s where we come in. From ad impact tracking to historical trend analysis and campaign optimization at scale, we give sellers the kind of leverage that used to be reserved for big brands with in-house data teams. Now, anyone can make informed decisions that directly shape their bottom line, and maybe even grab a slice of Amazon’s $1.5 billion-a-day pie.

So, How Much Does Amazon Make a Day?

Here’s the bottom line: Amazon makes roughly $1.5 billion a day, but that number doesn’t tell the full story. The company’s real strength isn’t just in what it earns, it’s in how it earns it. From cloud infrastructure and ad tech to its vast seller network, Amazon is less a store and more a living ecosystem.

And while it may feel like it’s simply a place to order paper towels or stream a show, what’s happening behind the scenes is one of the most complex, high-speed business operations on the planet.

FAQ

1. How much money does Amazon make in a single day?

On a typical day, Amazon brings in around $1.5 billion in revenue. That includes everything from product sales and Prime subscriptions to ad revenue and AWS. On big event days like Prime Day, that number can jump past $7 billion.

2. Does Amazon actually make a profit from all that daily revenue?

Yes, but not all revenue is equally profitable. Retail margins are tight, especially for first-party sales. The real profit drivers are AWS, advertising, and subscriptions like Prime. That’s where Amazon sees higher margins and consistent growth.

3. What’s the biggest contributor to Amazon’s daily income?

Online retail still leads in raw dollars, bringing nearly $700 million per day. But third-party marketplace sales are growing fast, and AWS remains the highest-margin segment. It’s a layered model – volume plus diversification.

4. How do Prime Day and other sales events affect daily revenue?

They supercharge it. On Prime Day 2024, Amazon pulled in over $14 billion across two days – averaging $7.1 billion per day. It’s not just more traffic, either. People spend more, and third-party sellers drive a huge portion of those sales.

5. What role do ads play in Amazon’s daily earnings?

A surprisingly big one. Sponsored product ads, display ads, and brand placements add up to nearly $40 million a day. Ads also shape what shoppers see and buy, which in turn drives even more revenue through higher product visibility.

6. Why does Amazon invest so much in logistics and tech?

Because speed and scale are the backbone of their entire business. By building out infrastructure, robotics, AI tools, and same-day delivery, Amazon reduces long-term costs and creates a shopping experience that’s hard to match – and that keeps people coming back.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback