What the Amazon Haul Program Really Is and Why It Changes Low-Cost E-Commerce

Amazon Haul isn’t just a feature update – it’s a new layer of shopping inside the Amazon ecosystem. Focused on low-priced, mobile-first products shipped direct from China, it targets the same crowd Temu and Shein are after. Products are priced under $20, the interface feels like social media, and shipping skips Prime entirely. It’s live in the US and UK, and while still in beta, it’s already shifting how Amazon frames pricing, delivery, and discovery.

A Quick Breakdown of What Amazon Haul Actually Is

Amazon Haul is a mobile-only shopping space where nearly everything costs under $20 – and often a lot less. It’s not just a subcategory inside Amazon. It sits on its own tab in the mobile app, separate from the main storefront, and it’s built for quick, no-pressure browsing. Listings are stripped down, with no bullet points, no A+ content, and no Prime badge. You’ll see a product, a title, a thumbnail, and a price – that’s about it. The goal isn’t comparison shopping. It’s low-friction buying, mostly driven by price and curiosity.

Every item ships straight from China, bypassing Amazon’s usual Prime infrastructure. That means slower delivery – typically 7 to 14 days – but also price points that drop below what you’d expect on the main platform, sometimes even under a dollar. Haul is in beta and available in the US, UK, Germany, Australia, and other select markets. Amazon is testing how far they can lean into Temu-style discount shopping – but inside their own system.

How Amazon Haul Works (and Why It Doesn’t Feel Like Regular Amazon)

Amazon Haul runs on its own rules. It’s a separate shopping experience within the Amazon ecosystem, initially launched as mobile-only but now accessible on both the Amazon app and desktop/mobile web browsers. It’s separated on purpose.

Once inside, you’ll notice the shift immediately. Product listings are barebones: short titles, basic photos, no bullet points, no detailed specs. No comparison tables, no “frequently bought together” sections. The interface feels more like a social feed than a product catalog. It’s lean, visual, and focused on just one thing – getting you to tap “buy” without overthinking it.

Everything ships direct from China. That means no Prime, no one-day delivery. Shipping takes 7 to 14 days on average, though sometimes it moves faster than expected. There’s a flat shipping fee unless you cross a minimum spend threshold of $25 in the US or £15 in the UK to unlock free delivery. It’s not built for urgency – it’s built for value.

Compared to the regular Amazon shopping flow, this is clearly a different lane. No pressure to filter or sort. No overwhelming sea of reviews. You scroll, tap, maybe buy a few things you didn’t plan to – and that’s exactly how it’s supposed to work. Haul isn’t trying to replicate Amazon’s core experience. It’s trying to own the space Amazon hasn’t: low-cost, mobile-first discovery.

What Makes Amazon Haul a Different Kind of Store

Amazon Haul doesn’t build on the core Amazon experience – it runs alongside it with its own logic. Lightweight listings, mobile-first design, and ultra-low pricing all come together to create a shopping flow that feels closer to TikTok than traditional e-commerce. Here’s what sets it apart:

- Mobile-only access: You won’t find Haul on the desktop. It’s baked into the Amazon app and mobile browser experience – built for tap-first behavior, not tab-heavy browsing.

- Barebones product listings: No bullet points, no enhanced content, no deep specs. Most listings are just a title, an image, and a price. It’s visual, scrollable, and designed to keep momentum.

- Low pricing model: Most items are under $10, some even below $1. The format favors volume over margin, with upsell nudges like “free shipping over $25” baked into the cart flow.

- Non-Prime delivery: Orders ship direct from China. That usually means 7 to 14 days for delivery, with no Prime badge or one-day shipping – but it helps keep pricing minimal.

- Runs on a different backend: Haul isn’t a filtered version of Amazon’s main catalog. It has separate inventory, its own seller structure, and different fulfillment paths. Most sellers can’t opt in – at least not for now.

It’s not a tweak to Amazon. It’s a parallel experience – tuned for casual buyers, low-cost items, and quick decisions.

What Amazon Haul Means for Everyday Buyers

Amazon Haul feels more like a side quest than a main shop. It’s not built around urgency, speed, or high-volume needs – it’s built around pricing psychology. If you’re used to Prime with its fast delivery, detailed product pages, and endless reviews, Haul reads differently. There’s no urgency to compare or scroll through filters. Products are simple, listings are minimal, and price is the only real driver. Buyers scroll, click, and sometimes buy – mostly because the threshold is low and the commitment is even lower.

That kind of interaction rewires buyer behavior. Haul encourages impulse decisions, not planned ones. No one’s here to hunt for specs or read ten reviews – it’s just “this looks useful, and it’s $3.” Over time, that pattern starts to influence how users engage across the broader Amazon app. They toggle between main Amazon and Haul, and that split experience can shift how they view value, urgency, and quality across the board.

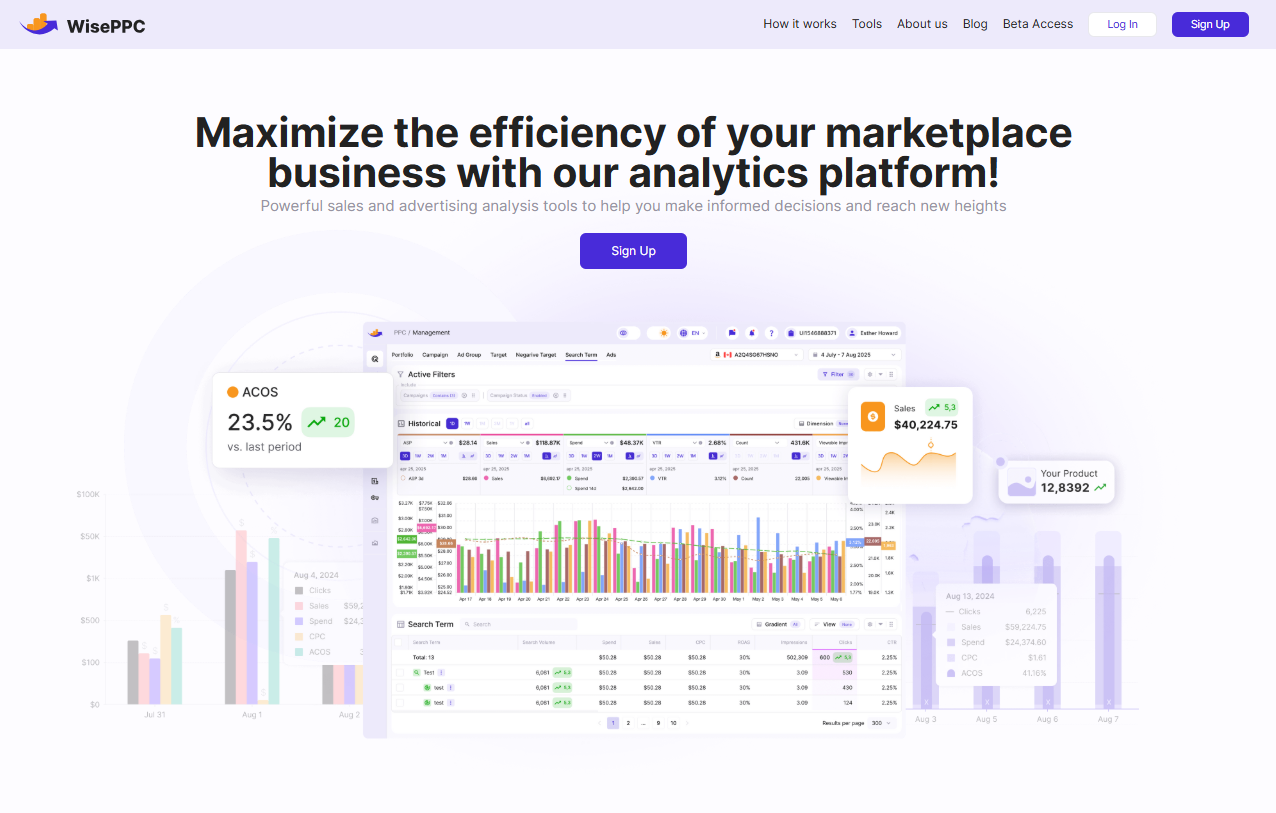

As WisePPC, we track how behavioral shifts like this ripple into performance data. When a format like Haul gets traction, we look at what it does to campaign visibility, conversion efficiency, and pricing elasticity – especially in categories that lean toward low-cost, high-volume SKUs. That’s exactly why we built our platform around granular, real-time analytics. Sellers using WisePPC can monitor changes in ad behavior or organic reach as new buyer flows emerge – and adjust before the trends settle in. If you follow us on LinkedIn, Facebook, or Instagram, you’ve probably already seen us unpack some of these shifts as they unfold.

What You’ll Actually Find on Amazon Haul

The product mix on Amazon Haul leans heavily into low-cost, low-friction categories – the kind of stuff people don’t plan to buy but end up adding to their cart anyway. It’s optimized for speed: quick decisions, small totals, no research. That’s reflected in what shows up most often across the listings.

Here’s the type of products that tend to dominate:

- Basic home and kitchen gadgets (think silicone funnels or LED tap lights)

- Low-cost phone accessories and cables

- Makeup tools, hair clips, and small grooming items

- Stationery, pens, stickers, organizers

- Entry-level fitness gear like resistance bands or sliders

- Simple jewelry and fashion add-ons

- “TikTok made me buy it” items that don’t need a brand name

There’s very little overlap with high-consideration purchases. No expensive electronics, no in-depth product pages, and almost nothing with multiple variations. If a product needs explanation, it’s probably not on Haul. What’s there is lightweight, visual, and disposable by design – which makes sense given the stripped-down layout and one-scroll buying logic.

Can Third-Party Sellers Join Amazon Haul?

Right now, the short answer is no – at least not through any open process. Most of the listings on Amazon Haul appear to be sourced through Amazon’s own global supply chain or direct manufacturer partnerships. There’s no seller dashboard toggle for Haul, no dedicated program to apply for, and no FBA integration in the usual sense. The inventory is curated, and entry is tightly controlled – likely to manage quality, logistics, and price structure while the format is still in beta.

That said, Amazon has a long track record of launching invite-only programs that later open up more broadly. Vine, Premium A+ Content, and even Prime itself followed that same trajectory. If Haul gains traction, it’s reasonable to expect that some level of seller access will follow – likely with restrictions on product type, pricing, shipping model, and listing format.

For sellers watching this space, the key is timing. By the time formal access is announced, the most agile competitors will already have compliant SKUs, supplier agreements, and margin structures ready to go. If you’re managing a catalog that includes lightweight, low-cost, or trend-driven items, it may be worth building a small Haul-compatible segment now – not to launch, but to be ready. The opportunity won’t come with a long lead time. And in this kind of model, being first matters.

Where Amazon Haul Stands Now – and Where It’s Likely Headed

Amazon Haul isn’t a quiet experiment anymore. It started in the US and UK, but by now, it’s landed in multiple international markets including Germany, Australia, Mexico, the UAE, and Saudi Arabia. It’s still mobile-only and technically in beta, but that label feels more like a formality at this point.

Available Markets So Far

Right now, Haul is live in at least six countries and growing. The US and UK were first in, followed by new rollouts in Australia and Germany during mid-2025. The experience stays consistent: you’ll find it in the Amazon app under its own tab, with a separate cart, stripped-down listings, and a focus on cheap, fast-sell products. Amazon isn’t shouting about this expansion, but it’s happening – quietly and strategically.

What’s Likely Ahead

If current performance holds, Haul is heading for a broader rollout across more European and APAC markets. But Amazon will move carefully. They’re watching what happens to order value, repurchase rates, and how this low-cost tab affects core marketplace habits – especially Prime. Expect tighter rules around things like GDPR compliance, CE markings, and localized logistics if Haul scales in the EU.

Why This Actually Matters

This isn’t just another app feature. Haul is shaping buyer behavior – what they expect to pay, how long they’re willing to wait, and what kind of product page they’ll accept. If you’re selling internationally, you’ll want to know when Haul hits your region. Because whether you list there or not, it’s going to move the bar for attention and conversion elsewhere too.

Conclusion

Amazon Haul isn’t just a discount corner – it’s a shift in how the platform experiments with buyer behavior, mobile-only design, and ultra-lean listings. It strips away most of what Amazon is known for and tests what happens when you remove the layers: the reviews, the urgency, the trust signals, even the delivery speed. What’s left is price, simplicity, and speed – and in the right context, that’s enough to move volume.

FAQ

1. Does Amazon Haul affect ads or conversions on regular Amazon listings?

It can. Even if you’re not selling through Haul, changes in buyer behavior and pricing expectations can ripple through adjacent categories. It’s something we monitor closely at WisePPC.

2. Can I use Amazon Prime to get faster shipping on Haul orders?

No. Haul products ship directly from China, outside of Prime. Delivery usually takes 7 to 14 days, and while it’s slower, it’s part of how prices stay low.

3. Why do product listings on Haul look different from regular Amazon listings?

They’re intentionally minimal. No bullet points, no detailed specs – just title, image, and price. Haul prioritizes visual browsing over deep product comparison.

4. Is Amazon Haul open to third-party sellers right now?

Not at this stage. Most products come from Amazon’s own supply network or manufacturers through direct sourcing. There’s no seller opt-in – at least not yet.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback