Amazon Buy Box 2025: A Real-World Guide to Winning Visibility and Sales

There’s no polite way to say it; if you’re not winning the Buy Box in 2025, you’re probably invisible. Whether you’re a private label seller, a wholesaler, or running a hybrid Amazon model, your odds of getting the sale depend heavily on whether your offer shows up in that all-important box with the “Add to Cart” and “Buy Now” buttons.

And here’s the kicker: the rules for winning the Buy Box keep changing. Amazon has been tightening the screws on seller performance, fulfillment speed, and price integrity. So if you’re still operating on last year’s playbook, chances are you’re getting left behind.

In this article, we’ll get into what’s changed, what still matters, and what to focus on if you want to stay competitive in a marketplace that rewards precision, consistency, and speed over price slashing and guesswork.

The Buy Box: What It Really Means in 2025

First, let’s get one thing out of the way. The Buy Box isn’t just a design feature. It’s a filter. And it filters sellers based on trust.

Amazon has rebranded it as the “Featured Offer,” but most sellers still call it the Buy Box. It’s the place where the platform highlights the seller it deems most reliable, relevant, and customer-focused. And with over 80% of purchases going through it – higher on mobile – it’s become the gatekeeper to real revenue.

Multiple sellers can list the same product, but only one gets to sit front and center in the Buy Box at a given moment. That spot rotates, but it’s not random. It’s based on a formula that weighs everything from price to shipping method to customer satisfaction.

What’s New in the 2025 Buy Box Landscape?

A lot, actually. Amazon’s algorithm is now less forgiving and a lot more data-hungry. Here’s what sellers are adjusting to this year:

- Buy Box suppression is more common. If Amazon thinks your price is too high compared to other marketplaces, your listing may be hidden from the box altogether.

- External traffic now counts. Driving shoppers from off-Amazon platforms (like TikTok, Google, or Instagram) seems to influence your chances of owning the box.

- Account history matters more. Newer sellers have a tougher time breaking in, even if their prices are better.

- Fulfillment flexibility is key. Amazon wants speed, but they’re also wary of overloading their FBA network during sales surges. If you can’t pivot between FBA and FBM, you might miss out when it counts most.

The takeaway? Amazon is prioritizing consistency, not just price. And sellers who understand how to deliver that at scale are the ones dominating the box.

Factors That Influence the Buy Box in 2025

The Buy Box formula is still a black box in some ways, but here’s what we do know about the factors that are actively influencing seller visibility:

Shipping Performance

Fast, reliable shipping is non-negotiable. In most categories, if you’re not offering 24-hour delivery, you’re behind.

- FBA is still the fastest path to Buy Box eligibility. You get Prime shipping, fast fulfillment, and peace of mind.

- SFP is an alternative if you can meet Amazon’s standards. But it’s not for the faint of heart – metrics are strict, and the expectations are high.

- FBM can work for bulky or niche products, but your on-time delivery and customer response times have to be flawless.

If you can’t guarantee quick shipping, the algorithm will likely bump you down, even if your price is competitive.

Pricing Strategy

Yes, price still plays a role, but it’s not about being the cheapest. It’s about delivering value.

Amazon now factors in:

- Landed price: Item price plus shipping.

- Price parity: If your product is cheaper on Walmart or your Shopify store, your Buy Box may vanish.

- Pricing behavior over time: Wild fluctuations or pricing manipulation can lead to penalties or suppression.

Smart sellers are leaning on automated repricing tools that let them stay competitive without starting a race to zero. Some are even using logic-based rules to raise prices after competitors stock out – boosting profits without losing visibility.

Inventory Availability

It doesn’t matter how optimized your listing is – if your product is out of stock, you’re out of the game.

Amazon wants offers that are ready to ship. So you need:

- Clean, up-to-date inventory data.

- Restocking plans for peak periods (like Prime Day, Q4, or back-to-school).

- The ability to pivot between FBA and FBM if your main fulfillment channel gets overloaded.

Sellers using inventory tracking tools or hybrid fulfillment setups are in a stronger position to maintain Buy Box share.

Seller Performance Metrics

These haven’t changed much in definition, but they matter more than ever:

- Order Defect Rate (ODR): Should be under 1%.

- Late Shipment Rate: Keep it as close to zero as possible.

- Pre-fulfillment Cancellation Rate: Watch it closely, anything over 2.5% can hurt.

- Customer Response Time: Aim for under 24 hours.

Amazon sees these as trust signals. If you’re lagging behind, even slightly, the algorithm will rotate you out.

Customer Feedback

Reviews still hold weight. But what’s changed is how Amazon uses them.

Now it’s more about:

- Review recency: Old reviews don’t carry as much weight.

- Star rating averages: A 4.3 with lots of recent 5-star reviews beats a 4.7 with none in the past six months.

- Resolution behavior: How you handle negative reviews matters more than whether you get them.

Using automation tools to request feedback, track negative reviews, and respond quickly can move the needle in your favor.

What Smart Sellers Are Doing Differently in 2025

Let’s get real. Most sellers know they should offer fast shipping, competitive pricing, and solid customer service. But here’s where the sharpest sellers are gaining ground:

They’re Tracking Buy Box Share Like a Stock Portfolio

Top sellers aren’t flying blind. They’re watching their Buy Box performance the way a trader watches market trends – hour by hour, ASIN by ASIN. Instead of waiting for a dip in sales to clue them in, they use tools to track exactly when they lose the box and how long they’re out. This kind of visibility makes a huge difference. You can catch issues early, whether it’s a pricing mismatch, a stock hiccup, or a sudden competitor undercut, before your conversions take a hit. For them, Buy Box share isn’t a mystery. It’s a metric they manage, fine-tune, and act on in real time.

They’re Segmenting Strategies by Product Type

Not all categories behave the same. Sellers who understand the differences win more often. For example:

- Household consumables: Speed and price matter most.

- High-end electronics: Trust, reviews, and brand control are key.

- Bulky items (furniture, equipment): Accuracy and damage-free delivery outweigh shipping time.

They’re Using External Traffic as a Lever

Driving traffic from TikTok, Google Ads, influencer posts, or even email campaigns not only boosts conversions but may now factor into Buy Box calculations.

Amazon wants to reward sellers who bring new traffic to the platform, so if you can do that consistently, it gives you an edge.

Real-World Strategies to Win the Buy Box (Without Burning Out)

Winning the Buy Box isn’t about throwing every lever at once and hoping something sticks. The sellers who keep winning in 2025 are doing a few key things really well – and they’re doing them with discipline. It’s less about tricks, more about building habits that scale.

Here are some strategies that work without burning through your margins (or your sanity):

1. Use Repricing with Intent, not Panic

Yes, automated repricing is a must – but only if you’re setting the rules. Don’t just plug in a tool and let it undercut you into the ground. Build logic around:

- When to lower your price (and by how much).

- How to protect your floor margins.

- When to raise prices again (like when competitors run out of stock).

This is how top sellers stay competitive without wiping out their profit. Think of it as chess, not whack-a-mole.

2. Don’t Just Stock FBA – Layer Your Fulfillment

One fulfillment method is a strategy. Two is a safety net. FBA is still the fastest track to Prime eligibility, but it’s not bulletproof. Inventory limits, storage fees, and shipping delays can all creep in at the worst time.

Smart sellers are running a hybrid setup:

- Core inventory via FBA.

- Backup inventory via FBM or SFP (if you can meet the metrics).

That way, if Amazon’s network slows down or limits your stock, you’re not knocked out of the rotation.

3. Train Your Listings to Convert

You can win the Buy Box and still lose the sale if your listing looks like it was slapped together in 2017. Amazon’s algorithm is watching conversion rate too, so treat your listings like storefronts, not footnotes.

Here’s what helps:

- Clear titles with relevant keywords.

- Bullet points that explain benefits, not just features.

- High-quality images (and lifestyle photos if the category supports it).

- A+ Content if you’re brand registered.

When your listing converts, Amazon sees you as the “safe bet” – and that bumps your Buy Box odds.

4. Pay Attention to What Triggers Suppression

This one’s sneaky. You can lose the Buy Box without realizing it if your price is flagged as “too high”, even if your metrics are flawless.

Keep an eye out for:

- Price discrepancies across marketplaces.

- Unusual spikes or dips in delivery timelines.

- Feedback dips from a sudden batch of returns or defects.

Sometimes it’s not about what you’re doing wrong, but what’s changed in the ecosystem. Suppression can be triggered by external shifts you didn’t see coming.

5. Act Like a Data Analyst, not Just a Seller

Gut instincts are useful – until they cost you 40% of your daily sales. The sellers who are consistently winning are obsessed with their numbers, but not in a spreadsheet-hoarding way. They know what to track and how often to check it.

You’ll want to monitor:

- Buy Box percentage by ASIN.

- Your win/loss ratio after pricing changes.

- Fulfillment lag time (even inside FBA).

- Conversion rate swings when listings are updated.

It doesn’t have to be complicated – just consistent. Weekly check-ins beat once-a-quarter panic mode every time.

Common Mistakes That Still Hurt in 2025

You’d think most sellers would know better by now, but these mistakes are still costing people the Buy Box:

- Setting lower prices on Shopify than on Amazon.

- Letting FBA inventory run dry without an FBM backup.

- Ignoring negative feedback until it tanks your metrics.

- Failing to respond to buyer questions or complaints within 24 hours.

- Not tracking Buy Box suppression triggers like high price swings or long delivery times.

It’s not enough to be competitive. You have to be consistent.

How WisePPC Help Sellers Win and Keep the Buy Box

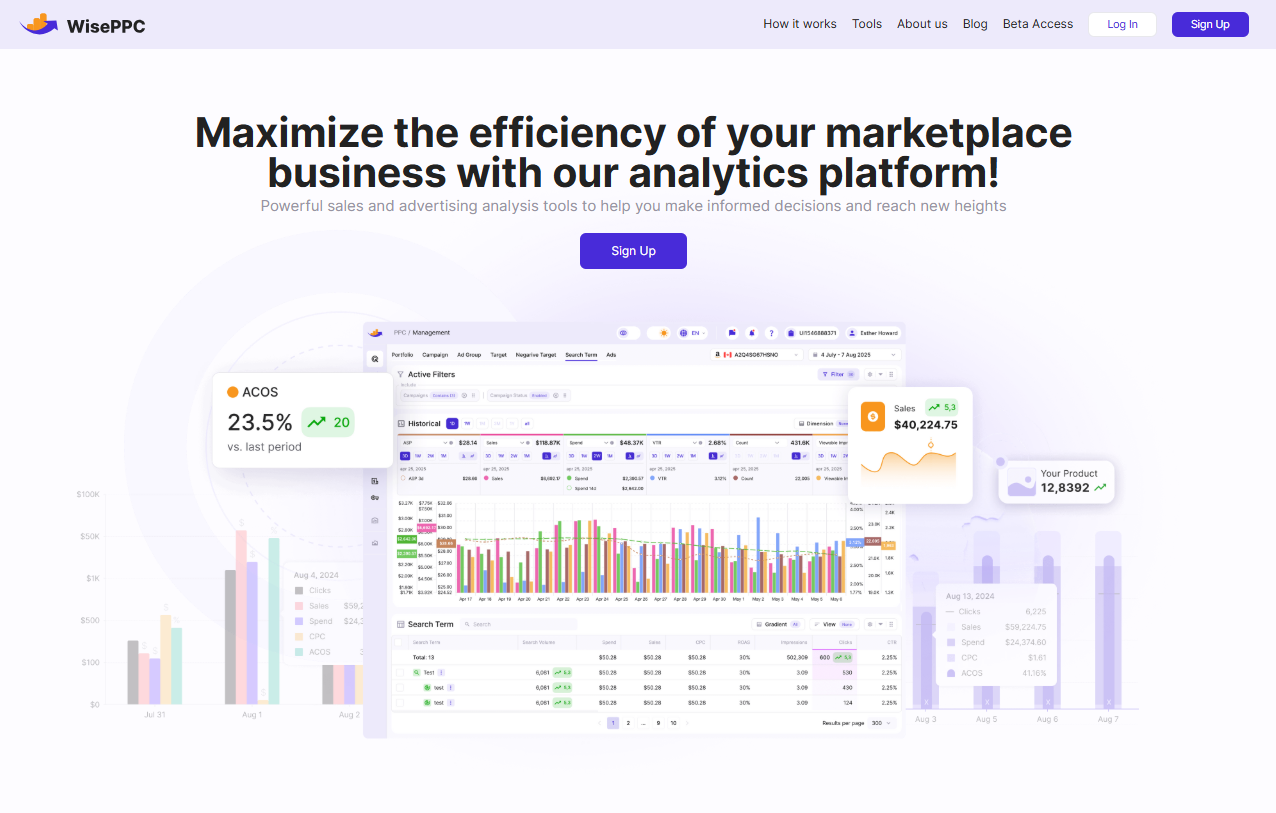

At WisePPC, we’ve seen firsthand how the smallest shifts in data can make the biggest difference in Buy Box performance. That’s why we built our platform around clarity, speed, and control. We don’t believe in guesswork – we believe in making sure you know exactly what’s working, what’s not, and where to focus next.

Our tools help you zoom in on the metrics that matter most when competing for the Buy Box. Whether it’s understanding how your ad placements affect sales, catching price anomalies before they trigger suppression, or spotting underperforming targets at scale, we’re here to give you the kind of visibility that sellers often don’t get through Seller Central alone. Everything is built to be fast, intuitive, and tailored for marketplace complexity, because managing 20 campaigns shouldn’t feel like juggling 200.

We’re also Amazon Ads Verified, which means our data integrations and optimization practices meet Amazon’s own standards. That gives you an extra layer of confidence when you’re adjusting bids, testing new strategies, or scaling up during peak periods. If you’re serious about owning more Buy Box share without burning time or budget, we’re built for exactly that.

Final Thoughts: Win the Buy Box by Thinking Like Amazon

The Buy Box isn’t just a feature. It’s Amazon’s way of rewarding consistency, speed, and reliability. And in 2025, it’s doing that more aggressively than ever. This isn’t about chasing shortcuts or trying to game the system. It’s about aligning with what Amazon values – good customer experience, data-backed decisions, and clean operations.

If you’re serious about growth, your Buy Box strategy should feel less like a gamble and more like a system. Understand your numbers. React to signals. Don’t guess where the problem is – know it. And don’t get discouraged if it takes some tinkering. The sellers who win aren’t always the flashiest. They’re the ones who show up with clarity, week after week.

FAQ

1. What’s the biggest factor for winning the Buy Box in 2025?

It’s a mix, but fulfillment speed and seller performance carry a lot of weight this year. Fast, reliable shipping (ideally FBA or SFP) paired with a clean track record is tough to beat.

2. Can I still win the Buy Box using FBM?

Yes, but it’s harder. You’ll need near-perfect shipping times and strong customer support. FBM works better in categories where fast shipping isn’t expected – think furniture or oversized items.

3. Does the lowest price always win the Buy Box?

No. Price is important, but it’s not everything. Amazon cares about overall value. If your performance metrics are stronger than a cheaper competitor, you can still win.

4. What triggers Buy Box suppression?

Usually it’s pricing issues like listing your product way above what it’s sold for elsewhere. Suppression can also happen if your delivery timelines or seller metrics fall out of Amazon’s acceptable range.

5. How often does the Buy Box rotate between sellers?

It depends on how many sellers are competing for that ASIN and how close their performance metrics are. If everyone’s metrics are solid, Amazon may rotate the Buy Box hourly or even more frequently.

6. Is it worth investing in a Buy Box monitoring tool?

If you manage more than a few ASINs, yes. Tools that track your Buy Box share and alert you to changes can help you fix issues before they cost you sales.

7. Does external traffic help with Buy Box ownership?

It seems to. While Amazon doesn’t confirm it directly, many sellers report better Buy Box visibility when driving steady off-platform traffic from places like Google Ads, TikTok, or Instagram.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback