How to Sell on Amazon Canada: Step-by-Step Guide

Selling on Amazon isn’t just for the U.S. crowd. North of the border, Canada’s marketplace is growing fast and offers sellers a shot at less competition, lower ad costs, and a loyal base of Prime shoppers. The setup is similar to what you’d expect if you’ve sold on Amazon before, but there are some twists to know about taxes, shipping, and pricing in Canadian dollars. In this guide, we’ll walk through what it takes to start selling on Amazon.ca, what makes the Canadian market different, and why it might be a smart next move for your business.

Why the Canadian Marketplace Deserves Your Attention

Amazon.ca pulls in more than 160 million visits each month, and as of 2025, about three-quarters of Canadians shop online. Amazon has roughly 40 percent of the e-commerce market in the country, which makes it the dominant player.

For sellers, the advantages include:

- Lower competition: There are fewer sellers in Canada than in the U.S., which makes it easier to get visibility.

- Cheaper ads: PPC costs are noticeably lower, so you can stretch your ad spend further.

- Diversification: Selling in more than one marketplace reduces the risk of depending on a single source of income.

- Prime loyalty: Canadian shoppers love Prime, and products fulfilled by Amazon often get an instant trust boost.

Of course, Canada’s market isn’t as big as the U.S. That means sales volume may be lower, but the margins can still be healthy.

Who Can Sell on Amazon.ca

The good news is that you don’t need to be a Canadian resident to sell on Amazon.ca. U.S. sellers and international businesses can set up a Canadian seller account and start listing products without physically being in the country. This makes it one of the easier international marketplaces to expand into, since you can test demand without a large upfront investment.

Non-resident sellers can operate on Amazon.ca under their existing business structure, but they should be aware of tax rules. At first, Amazon often takes care of collecting and remitting sales taxes. Once sales pass a certain threshold, though, you’ll likely need to register for a GST or HST number and start managing taxes directly. This step not only keeps you compliant but also allows you to reclaim some import duties, which can make a noticeable difference in profit margins.

For Canadian-based sellers, the process looks a little different. They usually need a GST or HST number from the start and often prefer having a Canadian bank account so payouts are in local currency. That avoids unnecessary exchange rate losses and simplifies bookkeeping. In both cases, Amazon’s flexibility makes it easy to get started. You don’t have to set up a warehouse or office right away, which means you can focus on testing the market and growing at your own pace.

Key Differences Between Selling in Canada and the U.S.

If you’ve sold in the U.S., you already know the basics, but Canada has its own quirks:

- Taxes: Canada relies on a layered system that includes GST, HST, and PST, instead of the state-by-state sales tax used in the U.S. The rates vary depending on the province, so your final selling price may need adjusting to stay competitive while covering these costs.

- Shipping: Unlike in the U.S., Amazon doesn’t offer a partnered carrier program for inbound FBA shipments in Canada. That means you’ll need to arrange your own logistics, often through freight forwarders that can handle customs and duties. The wide geography of Canada makes reliable shipping partners even more important.

- Currency: All listings must be in Canadian dollars, which adds another layer of planning. Exchange rates shift constantly, and if you don’t build in a buffer, your margins can shrink without warning. Having a Canadian bank account can also help reduce conversion losses.

- Customer behavior: Canadian shoppers share similarities with U.S. buyers but also have distinct habits. Many pay close attention to sustainability claims, appreciate bilingual content in English and French, and shop with seasonal needs in mind, from winter gear to summer outdoor essentials.

These differences don’t make Canada harder, but they do mean a direct copy of your U.S. strategy may not deliver the best results.

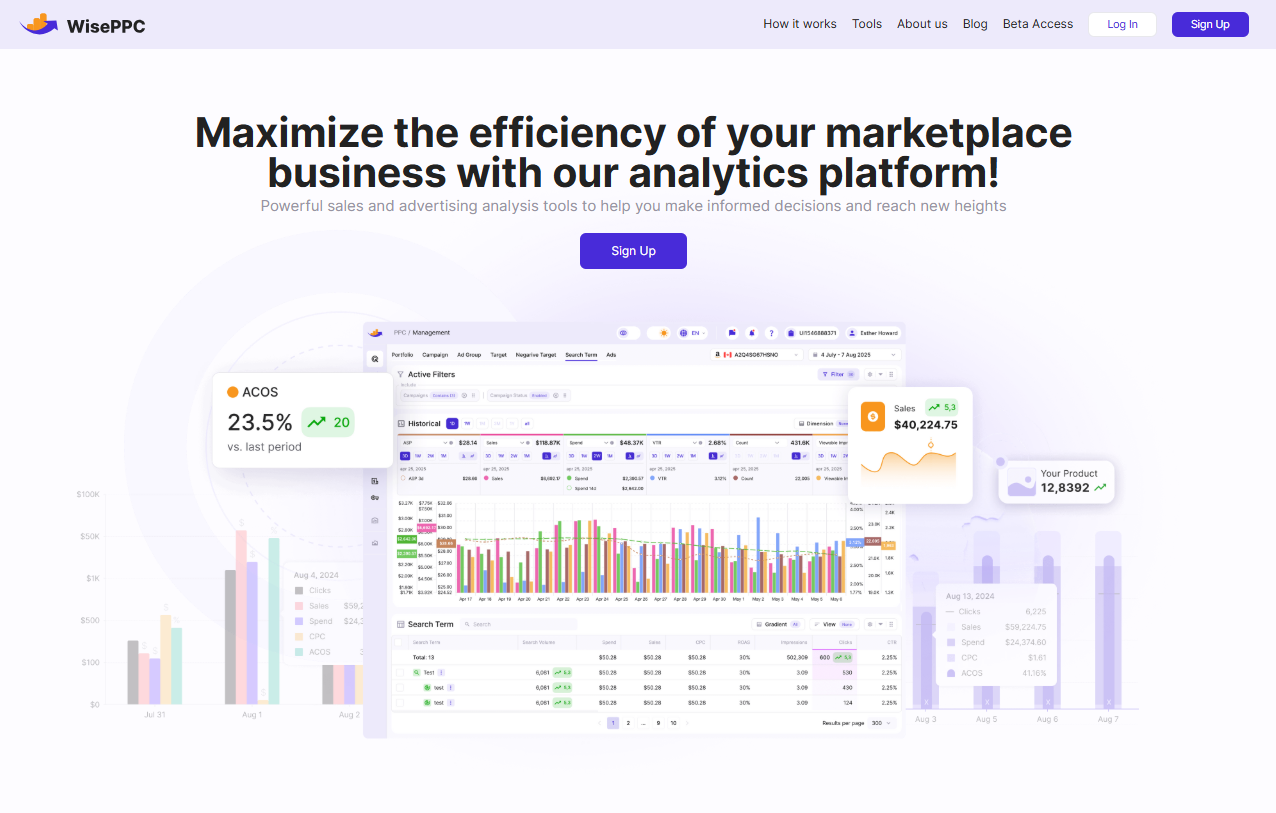

How WisePPC Helps Sellers Win in Canada

Selling on Amazon Canada comes with plenty of moving parts. Between taxes, shipping, and adapting your listings to local preferences, it’s easy to lose sight of the bigger picture: how your ads and sales are really performing. That’s where we come in. At WisePPC, we built our platform to give marketplace sellers more clarity and control, no matter which region they expand into.

Because we’re an Amazon Ads Verified Partner, our tools integrate directly with Amazon’s systems. That means you’re working with reliable data, updated in real time, not rough estimates or outdated reports. For sellers entering the Canadian market, this makes a difference. You can see whether your revenue is coming from ads or organic sales, monitor performance by placement, and react quickly when trends shift.

Here’s how we support sellers expanding into Amazon.ca:

- Bulk updates at scale: Adjust thousands of campaigns or targets in just a few clicks, saving hours of manual work.

- Long-term data storage: Access years of historical performance data, not just the 60 to 90 days Amazon provides.

- Placement performance analysis: See exactly which ad placements are driving results and fine-tune your bidding strategy.

- Real-time insights: Track TACOS, ACOS, CTR, and profit live, making it easier to spot and respond to changes quickly.

- Simplified decision-making: Our system highlights wasted ad spend, ineffective keywords, and overperforming campaigns so you know where to act first.

In short, WisePPC is about making smarter decisions with less guesswork. Whether you’re testing the waters in Canada or managing hundreds of products across multiple marketplaces, our toolkit is designed to scale with you. Expansion is challenging enough. We make sure your analytics, ads, and strategy keep pace with your goals.

Now that we’ve covered what makes the Canadian marketplace unique and the tools that can give you an edge, let’s get into the practical steps of setting up and running your Amazon.ca seller account.

Step 1: Choose Your Selling Plan

Like other Amazon marketplaces, Amazon.ca offers two plans.

- Individual Plan: You pay CAD 1.49 for every item sold. It’s best if you’re testing products or plan to sell fewer than 30 units per month.

- Professional Plan: Costs CAD 29.99 per month, no matter how many units you sell. This plan unlocks advanced tools, advertising, and access to programs like Brand Registry.

Most serious sellers end up choosing the professional plan, but starting small with an individual plan can make sense if you’re just experimenting. The good news is you can switch between plans at any time.

Step 2: Set Up Your Amazon.ca Account

Getting registered isn’t complicated, but you’ll need to gather some documents and details before you begin.

What Amazon requires:

- An email address (to log into Seller Central)

- A chargeable credit card (Visa, Mastercard, or Amex)

- A bank account number and routing number for payments

- Government-issued ID (like a passport)

- Tax information (GST/HST registration if applicable)

- A valid phone number for verification

The registration process asks for your business type. If you don’t have a corporation or LLC, you can select “Individual.” Amazon will then verify your identity before approving your account.

Step 3: Understand Taxes and Compliance

One of the biggest differences between selling in the U.S. and Canada is how taxes are handled. Canada has three types of sales taxes:

- GST (Goods and Services Tax): 5 percent, applied nationwide.

- HST (Harmonized Sales Tax): A combined tax in some provinces, usually 13 to 15 percent.

- PST/QST/RST (Provincial Taxes): Collected separately in provinces like British Columbia, Quebec, Manitoba, and Saskatchewan.

If you’re a non-resident seller, Amazon often collects and remits taxes on your behalf. But once your sales cross CAD 30,000 in a 12-month period, you’re required to register for GST/HST yourself. Registering can also give you the ability to reclaim import duties and improve your margins.

It’s worth consulting a Canadian accountant or tax advisor, especially if you plan on scaling.

Step 4: Decide on Fulfillment – FBA or FBM

When it comes to getting your products into customers’ hands, you have two main choices.

Fulfillment by Amazon (FBA)

With FBA, Amazon handles storage, packing, shipping, and even customer service. Products also qualify for Prime, which can boost conversions. The trade-off is higher fees, and in Canada, those fees are slightly more expensive than in the U.S.

Fulfillment by Merchant (FBM)

If you’d rather keep control, you can ship items yourself or use a third-party fulfillment partner. FBM can make sense for oversized products or items with very low margins, where FBA fees would eat your profits.

Most sellers prefer FBA because of the convenience and Prime eligibility, but FBM has its place depending on your product line.

Step 5: Shipping Products Into Canada

If you’re a U.S.-based seller, you’ll need to think about logistics.

Options include:

- Send inventory directly to Canadian fulfillment centers: More reliable for fast delivery, but you’ll need to deal with customs paperwork.

- Use Remote Fulfillment with FBA (NARF program): Amazon ships Canadian orders directly from your U.S. inventory. It’s simple to set up, but shipping takes 7 to 12 days and customers may see import fee notices, which can hurt conversions.

- Work with freight forwarders offering DDP (Delivered Duty Paid) services: They handle customs, duties, and paperwork so Amazon doesn’t reject your shipment.

For most sellers, starting with smaller shipments makes sense until you know your sales velocity in Canada.

Step 6: Create and Localize Your Listings

Amazon.ca runs on the same algorithm as Amazon.com, but Canadian buyers aren’t always identical to their American counterparts.

Things to keep in mind:

- Metric system: Canadians expect centimeters and kilograms, not inches and pounds.

- Bilingual options: English works for most, but offering French descriptions can help reach Quebec shoppers.

- Seasonality: Canada’s climate swings mean big shifts in demand. Winter gear, for instance, is a huge seasonal category.

- Local preferences: Canadians often value sustainability and Canadian-made products.

When you bring over your listings from the U.S., make adjustments. Tweak titles, update measurements, and consider adding French translations where relevant.

Step 7: Price Products in Canadian Dollars

This part trips up many U.S. sellers. Simply converting USD to CAD isn’t enough. You need to factor in:

- Higher FBA fees in Canada

- Import costs and duties

- Exchange rate fluctuations

- What competitors are charging in CAD

For example, if you sell an item for $25 in the U.S., converting directly might suggest a CAD $34 price point. But if your competitors are charging CAD $39, you might be leaving money on the table by pricing too low.

Keep a close eye on margins, and consider opening a Canadian bank account to avoid losing money on repeated currency conversions.

Step 8: Manage Your Advertising and PPC

One of the biggest perks of Amazon Canada is cheaper ads. With fewer sellers bidding on the same keywords, your cost per click can be much lower than in the U.S.

Tips for running ads in Canada:

- Start with exact match campaigns to see how Canadian shoppers search.

- Monitor which keywords perform differently than in the U.S.

- Take advantage of the lower costs to gather data and refine your listings.

Even if your ad spend is smaller in Canada, you may see stronger returns on investment.

Step 9: Build Brand Presence and Trust

If you already have a trademark in the U.S., you can use it to apply for Amazon Brand Registry in Canada. This unlocks A+ Content, Sponsored Brands ads, and protection from counterfeiters.

Brand presence matters in a smaller market. Canadians may be more likely to support brands that present themselves professionally and clearly. Consistency in product detail pages, bilingual support, and customer-friendly policies can all build trust.

Step 10: Learn From Canadian Shoppers

At first glance, selling in Canada feels the same as selling in the U.S. The platform is identical, and the tools are familiar. But customer behavior isn’t always identical.

Some differences worth noting:

- Canadians often buy in smaller quantities due to higher prices and shipping costs.

- Reviews matter a lot, especially in a smaller market where competition is thin.

- Certain categories thrive because of climate, culture, or local preferences. Outdoor gear, personal care, and eco-friendly products often perform strongly.

Pay attention to reviews, questions, and keyword trends specific to the Canadian marketplace. That feedback loop will help you adapt quickly.

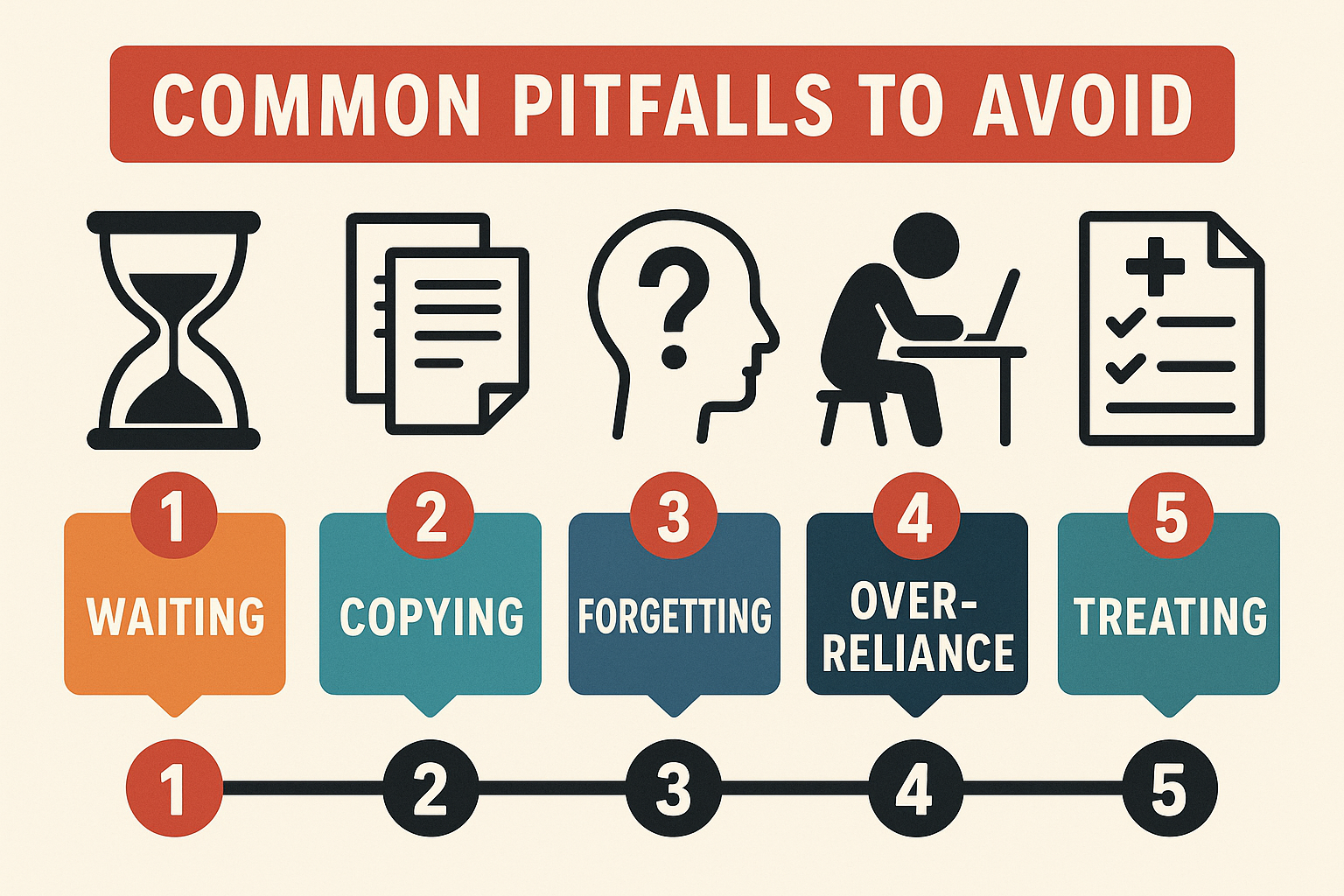

Common Pitfalls to Avoid

Plenty of sellers jump into Amazon.ca thinking it’s just a copy-paste version of Amazon.com. While the platforms look the same, the Canadian marketplace has its own rules and quirks. Here are the most common traps and how to avoid them.

Waiting Too Long to Register for Taxes

It’s easy to put off tax registration until you cross the CAD 30,000 sales threshold, but that usually leads to stress and missed opportunities. Registering for GST/HST early not only keeps you compliant, it also allows you to reclaim import duties and expenses that could otherwise eat into your margins. Treat tax planning as a starting step, not an afterthought.

Copying U.S. Pricing Without Adjustments

Simply converting U.S. prices into Canadian dollars is rarely enough. You need to factor in higher FBA fees, exchange rates, and what local competitors are charging. Some categories in Canada support higher margins, so underpricing just to match your U.S. listings can mean leaving profit on the table. A quick competitor check before setting prices can save you from expensive mistakes.

Forgetting to Localize Listings

Many sellers bring their U.S. listings straight over to Amazon.ca without adjustments. This can backfire. Canadians expect metric measurements, and in Quebec, many prefer or even require French-language details. Even small touches like spelling differences (color vs colour) can make your listing feel more local and trustworthy.

Over-Reliance on Remote Fulfillment

Remote Fulfillment with FBA is convenient because it lets you sell in Canada without sending inventory across the border. But it comes with slower shipping times and visible import fees for buyers. While it’s fine for testing, it shouldn’t be your long-term plan if you want repeat customers. Investing in Canadian FBA inventory usually pays off in stronger conversions.

Treating Canada as an Afterthought

Some sellers view Amazon.ca as a side project while keeping all focus on the U.S. That approach often shows in sloppy listings, inconsistent pricing, or poor customer service. Canadian shoppers can spot when they’re being treated as second-tier customers, and it hurts trust. If you want real results, treat Canada as a serious market worth building for, not just a bonus channel.

Final Thoughts

Expanding to Amazon Canada is one of the easiest ways to grow internationally. The setup is familiar, the marketplace is less competitive, and Prime shoppers are loyal. That said, the details matter. Taxes, shipping, fees, and cultural nuances can make or break your success.

Approach it with the same care you gave your first Amazon launch: research the market, test your pricing, and keep refining your listings. Done right, Amazon.ca can be more than just an add-on to your U.S. store. It can be a profitable channel that helps you diversify and scale in a sustainable way.

FAQs

Do I need to live in Canada to sell on Amazon.ca?

No, you don’t. Sellers from the U.S. and many other countries can open a Canadian seller account. You may eventually need to register for Canadian taxes if your sales grow past certain thresholds, but you don’t need to be physically based in Canada.

Is Fulfillment by Amazon (FBA) available in Canada?

Yes, FBA is available and widely used in Canada. Many sellers find it’s the best option because it gives customers faster delivery and Prime eligibility, which can boost conversions. You can also use Remote Fulfillment from the U.S., but shipping times are slower.

What taxes should I be aware of when selling in Canada?

Canada has a layered tax system that includes GST (Goods and Services Tax), HST (Harmonized Sales Tax), and PST (Provincial Sales Tax). The rates depend on the province where your customer lives. Amazon often handles collection and remittance, but once you pass CAD 30,000 in sales, you’ll likely need to register for GST/HST yourself.

Do I need a Canadian bank account to sell on Amazon.ca?

It’s not required, but having one helps. Without a Canadian account, Amazon will convert your payouts to your home currency, which can add extra fees. A Canadian bank account makes payments smoother and avoids exchange rate losses.

What types of products sell well in Canada?

It depends on the category, but Canadians often respond well to lifestyle products, health and wellness items, eco-friendly goods, and seasonal products tied to Canada’s climate. Looking at Amazon.ca’s best sellers and doing competitor research is a good way to spot opportunities.

Is it worth expanding to Amazon.ca if I already sell on Amazon.com?

For many sellers, yes. Competition is lower, ad costs are cheaper, and the unified account makes it easy to list products across U.S., Canada, and Mexico. Even if Canada’s market is smaller, it can become a reliable additional revenue stream.

Join the WisePPC Beta and Get Exclusive Access Benefits

WisePPC is now in beta — and we’re inviting a limited number of early users to join. As a beta tester, you'll get free access, lifetime perks, and a chance to help shape the product — from an Amazon Ads Verified Partner you can trust.

No credit card required

No credit card required

Free in beta and free extra month free after release

Free in beta and free extra month free after release

25% off for life — limited beta offer

25% off for life — limited beta offer

Access metrics Amazon Ads won’t show you

Access metrics Amazon Ads won’t show you

Be part of shaping the product with your feedback

Be part of shaping the product with your feedback